European companies spend more time on the road than counterparts in Asia or North America

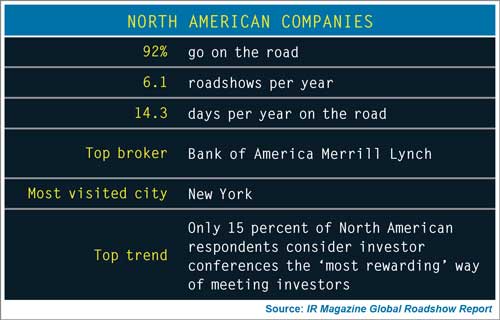

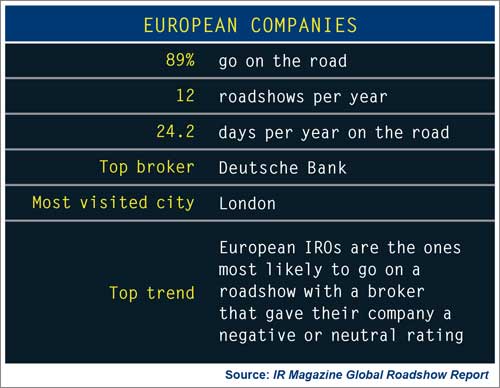

While almost all companies go on the road at some point during the year, there are significant differences between roadshow practices across North America, Europe and Asia, according to the IR Magazine Global Roadshow Report 2014.

For example, European companies embark on an average of 12 roadshows per year, compared with 6.1 in North America and 5.5 in Asia. Europe’s issuers also spend more time meeting investors out of the office, spending an average of 24.2 days on the road per year.

The report, which is based on a survey of more than 1,200 investor relations practitioners, also investigates broker use: respondents were asked which brokers their companies had partnered with over the last 12 months. The findings show that Bank of America Merrill Lynch is the most used broker by North American and Asian respondents, while Deutsche Bank comes out on top in Europe.

Among the less surprising results is the top city for each region: companies, as might be expected, tend to visit cities closer to home more often than investment centers in other regions. North American companies name New York as their most visited city, European issuers select London and Asia-based respondents pick Hong Kong.

Click here to find out more about the IR Magazine Global Roadshow Report 2014, which is available to download for free.