What does the scrutiny on corporate access payments mean for IR?

‘There’s no such thing as a free roadshow’ is an expression on the lips of many as the economics of how corporate access is paid for comes under increasing scrutiny.

In March, the UK’s Financial Services Authority (FSA) threatened big fines for asset managers that break its rules around paying for corporate access, and reiterated that commission payments may be used only to pay for execution and research. The rhetoric follows a report by the regulator in November that suggested it might begin interpreting rules regarding client commissions paid for corporate access more narrowly.

Talk of a clampdown is prompting a raft of questions about the usually unexamined ways in which brokers and banks arrange meetings with corporate management teams. A March 4, 2013 article in the Financial Times suggests some investors are paying as much as $20,000 for an hour of a chief executive’s time – without the CEO’s knowledge that his or her time is being bartered.

Some asset managers are already taking active steps to distance themselves from such practices. For example, AllianceBernstein has distributed a letter reiterating its existing policy of not using client commissions to pay for access to company management.

‘When this story became public, I was surprised and disappointed,’ says Helen Parris, director of IR at G4S. ‘I feel quite strongly that investors shouldn’t be paying for access to senior people.’

At G4S, Parris uses a number of house brokers to set up roadshows, and invites other brokerage firms to design additional roadshows from time to time. Before giving the green light to any roadshow itineraries, however, she carefully checks the list of appointments. ‘I prioritize those people I think we should be seeing, and not necessarily someone who’s generating a lot of commissions for [the broker] in other areas,’ she says.

Given the recent uproar about the methods of paying for corporate access, Parris plans to be even more vigilant in the future. ‘This reinforces for me that we really need to be seeing the people we want to see in those one-on-one meetings,’ she says.

The status quo

For many IROs, allowing house brokers and investment banks to set up roadshows has largely been a matter of convenience. Alicia von Sobbe-Grimberg, director of Roadshow Coordination, a London-based executive recruiter for capital access teams at banks and brokerage houses, observes that organizing a roadshow requires an enormous amount of logistical planning and attention to administrative detail.

That said, she maintains that having brokers arrange the roadshows might mean companies are ceding more control of the invitation list than they ought. ‘There could be key underweights that invest in a company’s peers but aren’t getting a look-in when the firm is coming to town because they don’t have any relationships with the broker hosting the roadshow,’ she explains.

Many see the regulator’s rumblings about corporate access as an opportunity to rethink how they’re designing roadshows and other investor-outreach events. Parris points out that her annual bonus hinges on meeting certain quantitative objectives, including targeting. ‘Everyone is focused on targeting, but I am especially so,’ she says. ‘I draw up a list of the targets for the year to make sure we target those that are underweight and non-holders. I think there’s a growing trend for companies to get involved themselves and not just go where brokers tell them.’

As the sole member of G4S’ investor relations team, Parris acknowledges that handling the administrative tasks associated with booking roadshows would be burdensome. ‘If I had a bigger IR team, I’d be more inclined to do those meetings directly,’ she adds.

Emma Burdett, chair of the policy committee for the UK’s IR Society and a partner and head of IR at London-based Maitland, points out that a possible crackdown could have a disproportionate effect on mid-caps and small caps simply because their IR teams are smaller. Practicalities aside, she believes recent conversations about how corporate access is financed may spur some long-overdue introspection. For her, the critical issues are the quality of the roadshows IROs and corporates are participating in and transparency over who is paying for what.

Too often, Burdett points out, ‘a company has four days of roadshows after results are announced, and it could be that up to 50 percent of those meetings are not a good use of time.’ The most common problems, she adds, include companies visiting inappropriate investors or meeting investment representatives too junior to make decisions.

Follow the money

Sarah Levy, head of investor relations at Kingfisher, says she gets barraged by requests from banks and brokers vying to set up roadshows for top management. Recently, however, she and the two other IR professionals on her team have been taking a decidedly more active role.

‘We do more targeting ourselves because the corporate access teams are smaller than ever,’ says Levy. ‘The banking crisis has led to lower headcounts and fewer people being able to manage roadshows for you.’ She also regularly pushes back against proposed roadshows if she feels the agenda hasn’t been carefully considered.

Richard Davies, managing director of Richard Davies Investor Relations, observes the same phenomenon. ‘The brokers are doing less and less because their own corporate access teams are being reduced in terms of employees,’ he notes. ‘Traditionally, companies have relied on the banks and brokers to manage that relationship, but it’s not fit for purpose in the modern age. The bank and brokerage system is changing. Trading volumes are lower, there’s less aggressive M&A, and fund management has become more international.’

Davies also maintains that the debate about paying for corporate access is muddied by people conflating two separate scenarios. First, regulators are examining fees paid by investors to brokers for a whole raft of services that typically fall under the heading ‘research’. These fees, asserts Davies, are no surprise given that someone must pay the brokers for setting up meetings. Second – and what’s raised the ire of many – is the idea that some investors, usually hedge funds, are directly forking over large sums to brokers to meet with their clients’ management teams.

Adrian Rusling, partner at Phoenix-IR in Brussels, makes a similar observation. ‘Some hedge funds are cutting a check, and it’s quite explicit,’ he says. ‘But for the vast quantity of people these fees are just bundled.’

Although the sums have spurred outrage, Rusling notes that the stakes involved in making major investments are staggeringly large. ‘If an institution is going to make a bet – if you’re going to invest $1 bn in a stock – spending $20,000 on something that’s really valuable to reassure you or just to double-check is worth it,’ he says. On the other hand, he acknowledges that these meetings might easily be arranged for free if an investor simply picked up a telephone, contacted the IRO and requested a meeting.

For Rusling, the crux of the issue boils down to this: who is the client? Under the current model, he says, the investor is the broker’s client and so the investor’s needs are being served. ‘The ‘best’ investor target for a company is not necessarily the ‘best’ investor target for the broker,’ he states.

Companies may balk at assuming the cost of arranging roadshows themselves or hiring independent third parties to do it for them, but doing so would shift the dynamic dramatically. What IR departments should prioritize, argues Rusling, is not the expense of targeting or even of administering a roadshow, but the value of a very scarce resource: the chief executive’s time.

While few IROs are currently hiring consulting firms like Rusling’s to arrange roadshows, working with an independent expert would have distinct advantages. ‘If we’re working for the issuer, there’s no conflict of interest. It’s not like we have to serve two masters,’ he says.

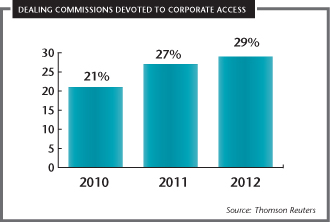

Steve Kelly, managing director of Thomson Reuters Extel, points out that the interest in – and value attached to – corporate access has risen over time. Extel surveyed 800 UK firms and found that 35 percent hold more than 250 one-on-one meetings a year. The research firm also reports that the proportion of dealing commissions devoted to corporate access grew from 21 percent in 2010 to 27 percent in 2011 and 29 percent last year.

Ripple effects

Precisely how a clampdown on fees paid for corporate access might play out remains to be seen. Were asset managers to refuse to allow commission dollars to go to corporate access, the commission pot might be allocated differently with more funds going to, for example, research.

This might also change the way in which public companies view the sell side. If executives haven’t been visiting the right investors but rather those who simply bring in large commissions for a broker, will the company trust the sell side in the future?

Another issue is the way the sell side has bundled costs, which many believe has served as a smokescreen for brokers for quite some time. Some have even voiced suspicions that companies dole out roadshows to brokerage houses in exchange for positive recommendations on a stock – and this might get a closer look, too.

Others predict that ripples will be felt beyond London, even though the issue might be most pertinent in the UK because of the retained house broker system. Davies notes that in other countries, ‘companies swap out their brokers more often’ and so the conflicts might be less pronounced.

In the IR world, one burning question is whether the debate over who pays for corporate access will spur public companies to revisit shareholder outreach in all its guises. Burdett maintains that the brokerage and banking world’s willingness to handle corporate access has quietly diverted resources from corporate IR departments. By contrast, she notes, large European companies that don’t have the same history of the house broker relationship tend to have far larger IR teams. ‘Big European firms will pay other intermediaries for roadshows at times, but they do quite a lot of it in-house (through investor targeting) and organize roadshows themselves directly with the investors,’ she explains.

When asked whether public firms in the UK might willingly foot the bill for their roadshows, Burdett is skeptical. ‘Investor relations budgets are not generally going up in the UK,’ she explains. ‘That’s part of the reason why it may take quite a while for this whole process to move forward.’

At G4S, Parris has found that directly targeting investors can yield some valuable insights. ‘What you miss going through corporate access with a bank or broker is knowledge of why people don’t want to see you,’ she points out. ‘If you never get to see [certain investors], you don’t know whether they’ve got some wrong perception around the company.’

Parris believes change is afoot but also feels reforms will most likely come gradually. ‘I think we probably will end up doing more targeting and roadshow planning in time,’ she concludes.

Regulator targets corporate accessAfter former UK regulator the Financial Services Authority (FSA) conducted a review of how well asset management companies managed conflicts of interest between June 2011 and February 2012, it identified ‘breaches of our detailed rules governing the use of customers’ commissions and the fair allocation of trades between customers’ in its November 2012 report, entitled ‘Conflicts of interest between asset managers and their customers: identifying and mitigating the risks’. The FSA concluded that most of the companies visited could not demonstrate that customers are avoiding inappropriate costs.In November 2012 the FSA also asked asset management firms to complete an ‘attestation’ supplying more detailed information on corporate access and other potential conflicts of interest by February 28, 2013. In what’s become known as the ‘Dear CEO letter’, the regulator noted that FSA rules limit what customers can purchase with commissions to ‘execution’ or ‘research’ services. The FSA said few governing bodies regularly reviewed whether the products and services purchased with client commissions were eligible to be paid for this way. Finally, the regulator noted that firms were unable to demonstrate how brokers arranging for access to company management constituted a research or execution service. While there has been no official rule or guidance change, a common industry reading of the letter is that the regulator has narrowed its interpretation of which services can be paid for through commissions, according to the Investment Management Association, the UK trade body for asset managers. Joseph Eyre, press office manager at the Financial Conduct Authority [the FSA split into two new organizations in April: the Financial Conduct Authority and the Prudential Regulation Authority], emphasizes that corporate access was ‘just one of a much wider range of issues we saw in the asset management industry.’ After the attestations are reviewed, the regulator will begin follow-up work, Eyre continues, noting that no timetable for this work has yet been announced. |

Change in the wind for the USIn 2006, when the SEC issued guidelines describing which expenses are allowed under soft-dollar commission arrangements, those guidelines identified ‘meetings with corporate executives’ as a legitimate research service, writes Brad Allen. At the same time, the guidelines explicitly excluded ‘travel and related expenses associated with arranging trips to meet corporate executives.’ With that hair-splitting definition as a foundation, the commission also acknowledged the desirability of getting UK and US regulatory environments into synch where possible, stating that it had taken into account the work of former UK regulator the Financial Services Authority (FSA) ‘in developing our position.’Over the past decade corporate access programs have morphed from a sideline for brokers to a multi-billion-dollar industry incorporating both non-deal roadshows and one-on-one meetings at conferences. Fast forward to 2013 and the state of play is very much in flux. With the UK taking the unambiguous view that meetings arranged with management members are not allowable expenses, is the corporate access industry in the US poised for major changes? A spokesperson for the SEC refused to comment. But given the scrutiny high-profile insider trading cases have brought upon expert networks – also a soft-dollar research service – any hint that orchestrated management one-on-one meetings have crossed the line could bring them under the commission’s spotlight. A recent Wall Street Journal report describing SEC investigations into fees charged to clients by hedge funds, which are major purchasers of corporate access, makes it easy to conclude that change could be on the horizon. ‘We haven’t heard anything’ that would suggest US regulators are adopting the UK view, says Sandy Bragg, CEO of Integrity Research, which covers the research industry. ‘But asset managers, which operate globally, implement certain procedures and processes in one geography and move them to another.’ Absent a scandal, Bragg does not see an enforcement push and suggests there is little appetite for change among brokers, issuers and money managers, all of which find the current system ‘convenient’. He also sees little need for change because ‘Reg FD is very clear… and that governs this whole area.’ One corporate access provider, who asked to remain anonymous for competitive reasons, sees little difference between a non-deal roadshow and a one-on-one meeting held at a broker-sponsored conference. ‘Are [buy-side investors] going to stop paying for conferences? I don’t see how that will work,’ he says. He also sees little need for regulatory intervention, pointing out that his clients – which are long-only investors – view one-on-one meetings as a way to ‘get comfortable’ with the management teams they invest in. ‘They’re not trying to get any secret information,’ he points out. Nonetheless, there are some skeptical voices. Tom Brakke, who consults with money managers and writes a blog about research, says the growth of corporate access ‘speaks to the weakness of the sell-side model. The sell side has become a matchmaker.’ He also finds the high price tag quoted for C-level one-on-ones troubling. ‘If you’re paying this kind of money, what are you expecting to get?’ he asks. |