As one of the world’s largest money centers, Boston provides an eclectic mix of investment firms and conferences

Boston is unique. With its deep historic roots, New England personality, regional dialect, great seafood and sports mania, time spent in Boston – ‘the hub’ – is always memorable.

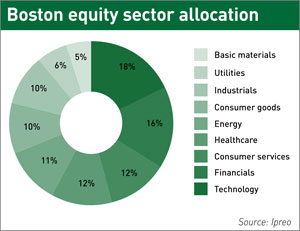

With $2.1 tn in equity assets under management, Boston also ranks as the second-largest money center both in the US and globally, and is fairly evenly split between growth and value investors, according to Ipreo.

Beyond sheer size, the eclectic nature of Boston’s investment community, which combines old money traditions and new economy savvy, is layered onto an historic city whose paved streets seem to follow narrow, crooked farm tracks.

As a result, Boston boasts one of the largest concentrations of long-only firms within walking distance of each other, making it a required stop on many roadshow calendars.

Rising number of conferences

Greg Parks, president of the Wall Street Calendar, a conference tracking firm, says that as the sell side has pushed management access over the past several years, he has seen a rise in the number of investor conferences as well. And it seems no city has benefited more from that phenomenon than Boston.

One theory as to why Boston’s conference count has been rising focuses on a 2006 change in New York’s income tax rules, which require non-residents to file returns if they spend more than 10 days in the Big Apple.

Whether that’s the reason or not, the trend seems to have taken on a life of its own. While New York still holds more investor conferences overall, according to the Wall Street Calendar the number of conferences held in Boston has risen by more than 30 percent since 2007, from 65 to 87 last year, while New York has seen a 17 percent decline over the same period, from 484 to 400.

Where to eat outside the hotelBoston does not lack for good places to eat and meet. Lunch largely depends on where your schedule takes you, and may involve a sandwich in a conference room or something more formal. If you’re still downtown and want a quick local eatery, head over to the Milk Street Café or try Trade in the up-and-coming waterfront financial district.If your C-team wants to get out of the hotel during the evening, you have plenty to choose from but reservations are advised. Check out No 9 Park on Beacon Hill for elegant and Boston proper; or try Radius, if French and four-star is what you’re after. Most restaurants provide seafood, but if you’re looking for a local spin, you might go to Union Oyster House or one of the several Legal’s Seafood branches around town. Prefer Italian? Head to the Strega in the North End and enjoy the ambience, or Davio’s in Back Bay. For a great American steakhouse, head to Grill 23 or Del Frisco’s. If you really hanker for local exotica, get in a cab and head to Redbones BBQ near Tuft’s University for the most generous, roll-up-your-sleeves servings of real southern barbeque a Yankee will find in these parts. And if the Red Sox are in town, head to baseball stadium Fenway Park for the famous Fenway Franks steamed hotdogs. |

Independent corporate access provider Rick Hanley, president and founder of Hanley Associates, describes Boston as ‘the most attractive city in the world for a company to market’. Hanley claims Boston still doesn’t get enough attention from IROs, who typically tack one day in Boston onto a two-day trip to New York.

‘They’ve got it backwards – especially when you consider the ratio of long-only funds to hedge funds, which makes New York much less attractive,’ he says.

If a management team could get meetings with the half-dozen largest equity funds, a Boston lineup would put them in front of more buying power in fewer meetings than any other metro area, Hanley observes.

Diverse audience

But size is not the city’s only attraction. Boston’s financial community is very diverse, notes Robert Meyers, global corporate access director at RBC Capital Markets.

He describes Boston as ‘one of the few global money centers with extensive product groups, analysts and portfolio managers who cover assets across market-cap ranges, sectors and regions.’

He also cites the growing number of hedge funds that have expanded there to take advantage of ‘the impressive track record of deal flow, non-deal roadshows, and industry events centered in Boston.’

Even with a traditionally conservative and guideline-driven investment approach among many mutual funds, Meyers says his firm has seen an increasing appetite among Boston’s larger investors to meet with US, European and Canadian companies that have global operations, mirroring an increasingly global investment orientation.

Nonetheless, he advises that patience may be necessary with some Boston money managers. ‘For those firms that are not current holders, it may take several meetings before a buy decision is reached,’ he explains.

Entrepreneurial spirit

James Buckley, managing partner at IR firm Sharon Merrill Associates, sees Boston’s broad-ranging investment community as a natural outgrowth of its own past successes.

In addition to star managers at marquee shops striking out on their own, the area’s rich university and research communities have spawned tech and medical/biotech start-ups.

Places to stayBoston Harbor Hotel70 Rowes Wharf +1 617 439 7000 The restaurants here are Meritage or Rowes Wharf Sea Grille: both provide fine dining with great harbor views. InterContinental Boston 510 Atlantic Avenue +1 617 747 1000 Breakfast, lunch and dinner are all available at Miel Brasserie Provençale, the hotel’s Côte d’Azur-themed in-house restaurant. Langham Hotel Boston 250 Franklin +1 617 451 1900 While many first meetings of the day start with breakfast at the Langham’s Café Fleuri, a call ahead is a good idea. BOND Restaurant & Lounge is a good choice for a small business lunch or dinner, as well as for late-night cocktails. |

That vibrant entrepreneurial culture has in turn attracted venture capital and private equity shops from elsewhere, creating arguably the most diverse financial community mosaic anywhere, Buckley argues.

No matter what your story, you can find an audience here, he adds. ‘It’s not like Boston’s a bad place to go if you’re a small cap,’ he observes.

Despite a growing number of hedge funds and momentum-driven investors, Boston retains its reputation as a long-only, buy-and-hold kind of town.

A 'must do', especially for young companies

It remains a ‘must do’ for IROs, and is especially attractive for young companies that have not yet been discovered: Boston is a market where they can get a hearing and find the first large investors that will stay with them for a long time.

On a nice day, Boston is a very walkable city, so with a little planning and luck, you can pack a lot of meetings into a day. But New England weather is notoriously unpredictable and can be nasty, so have a Plan B, just in case.

There are two main areas of the city to navigate. The core financial district downtown extends from State Street near historic Faneuil Hall through Post Office Square and down to South Station and the Federal Reserve to the waterfront.

Within this warren of streets, alleys, avenues and waterfront boulevards, you can easily build a day of meetings with some of the biggest companies (Fidelity, Wellington, Putnam) and a growing collection of newer, smaller shops, hedge funds and advisers.

The Back Bay was so named because surrounding hills were cut down to fill in the marshes behind Beacon Hill, creating a neighborhood where the streets could run in a more easily navigable grid pattern extending along Boylston Street.

Here you’ll find a broader mix, including the Boston Common and Boston Gardens, retail complexes, trendy Newbury Street, office towers and Symphony Hall, as well as investment giants like MFS and Bain Capital.

Conference scheduleBoston hosted nearly 90 investor conferences last year and is on track to do the same this year, according to conference tracking firm the Wall Street Calendar. This flow of companies and investors is a boon for local fund managers, but it requires some coordination. If you’re planning a roadshow that coincides with an unrelated industry conference, you might end up with an empty dance card.Some conferences have been going on forever – or so it seems – and are now traditions unto themselves. The Cowen Health Care Conference and the Canaccord Genuity Global Growth Conference, in particular, are local institutions. While there are some well-known IT, technology and banking & financial services conferences from the likes of JPMorgan, RBC Capital Markets, Oppenheimer, Citi and the Boston bank analysts society, the diversity of the investment community guarantees an eclectic mix of industry, sector, market cap and theme-focused events throughout the year. Looking ahead, consumer/retail is getting more popular, with new 2012 conferences by UBS in March and Wells Fargo in October. 2012 upcoming conferences (all dates inclusive) -32nd Annual Health Care Conference, Cowen Group, March 5-7 -Datacenter & Telecom Infrastructure Investor Day, RBC Capital Markets, March 8 -Global Consumer Conference, UBS, March 14-15 -Global Financial Institutions Conference, RBC Capital Markets, May 1-2 -Health Care Conference, Deutsche Bank, May 7-9 -40th Annual Global Technology, Media & Telecom Conference , JPMorgan, May 15-17 -Global Transportation Conference, Bank of America Merrill Lynch, May 17-18 -Retail Conference, Morgan Stanley, May 22-23 -Industrial Conference, KeyBanc Capital Markets, May 29-31 -Utilities Conference, Citi, May 30-31 -Communications Technology Investor Day, RBC Capital Markets, June 5 -SMid Cap Conference, Bank of America Merrill Lynch, June 6-7 -Healthcare Conference, Wells Fargo Securities , June 19-20 -12th Annual Consumer Conference, Oppenheimer & Co, June 26-27 -15th Annual Technology, Internet & Communications Conference, Oppenheimer & Co, August 14-15 -32nd Annual Global Growth Conference, Canaccord Genuity, August 14-16 -Global Industrials & Materials Conference, Bank of America Merrill Lynch, September 5-7 -Basic Materials & Packaging Conference, KeyBanc Capital Markets, September 10-12 -Global Industrials Conference, Citi, September 19-20 -Retail & Restaurants Forum, Wells Fargo Securities, October 2 -31st Annual Bank Conference, BancAnalysts Association of Boston, November 1-2 -Financial Technology Conference, Citi, November 7 Source: Wall Street Calendar |