Research reveals what senior managers consider vital to good investor relations

What do those in the C-suite think is most important about your IR program? According to the latest IR Magazine research, it appears senior managers want quick replies to investor queries and high-quality shareholder meetings above any other IR fundamentals.

The survey asked 142 respondents – 65 percent of whom are CFOs, 6 percent CEOs and 12 percent heads of IR – to rate the importance of several factors when measuring the quality of their firm’s IR. Factors were rated on a scale of zero to 10, with zero representing ‘not at all important’ and 10 ‘extremely important’.

The speed of responding to investors and meetings, roadshows and events for analysts and investors are considered the two most important factors by senior management when measuring IR. Three quarters (75 percent) of respondents rate various meetings as at least ‘very important’ (scoring more than eight), with 19 percent giving a perfect score of 10.

Just under seven in 10 (69 percent) rate prompt responses to their investment community as very important, though 21 percent give the practice a score of 10, which is the highest number of perfect scores given in any category. Both quantity and quality of analyst coverage is the third-most important area for measuring IR, with feedback from the investment community rated fourth.

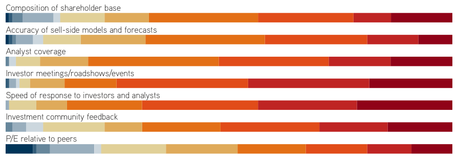

Least important for senior management appears to be the company’s P/E relative to its peers, the only category where more respondents provide a score of five or less (36 percent) than eight or more (33 percent).

In order to examine these scores more closely, each category is charted as a ‘heat bar’ (see below) with different colored sections representing the number of respondents assigning a particular score. These range from zero (not at all important) shown as a dark blue on the far left to 10 (extremely important) shown as a deep red on the far right. The more pronounced the red tones are, the more important a factor is considered by the survey’s senior management respondents.

(Source: IR Magazine research report: senior management and investor relations. Click for bigger version)

When respondents are split by company size, some clear trends start to emerge. Meetings, roadshows and events would be the most important area overall but for micro-cap respondents, who rate such meetings at an average of only 7.2. These respondents also consider the accuracy of sell-side models and forecasts less important to the quality of their IR programs, particularly when compared with mid-cap respondents (scoring 6.4 and 7.4, respectively).

As cap size increases, the relative importance of analyst coverage tends to drop, falling from an average of 8.2 at small caps to 7.5 at large and mega-cap firms. Micro-caps, meanwhile, rate it at an average of only 7.0, though the average number of analysts covering these firms is just 2.3, compared with 6.1 for small caps. It follows that analyst coverage may be considered too unpredictable or dependent on other factors to be an effective means of measuring IR for senior management at micro-cap firms.

All in all, it is clear that senior management across the board consider proper engagement, be it via responses to shareholder queries or actually meeting your investment community out on the road, to be one of the most important measures of good IR. Other factors, however, may well come down to a company’s specific situation, particularly for those that are smaller in market capitalization.

To read the full research report, click here