German companies consistently outperform firms from other countries in the IR Magazine Awards – Europe

Germany is no longer known exclusively for luxury cars and classical music composers. Recently, this country is gaining increasing recognition for producing some of the world’s best investor relations teams and for sweeping the European rankings of IR practitioners.

In the IR Magazine Euro Top 100 rankings for 2013, BASF and Lanxess come first and second, with Continental in fifth, Bayer in 11th and RWE in 15th place.

Meanwhile, BASF won IR Magazine’s large-cap grand prix award in 2013, 2011 and 2010, Allianz was the large-cap grand prix winner in 2012, and Lanxess took top mid-cap honors in three of the past four years.

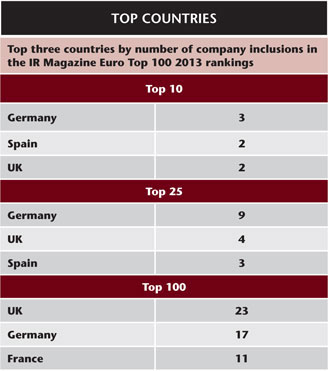

Although the UK, Spain, France, Switzerland and other European countries fare well by most global IR measures, German companies consistently secure a higher number of places in the top 25 IR rankings than the rest (see Top countries, below) – even though German companies arrived on the IR scene far later than their American or UK counterparts.

Source: IR Magazine Investor Perception Study – Europe 2013

‘The US was doing IR decades before we knew it would make sense to talk to investors,’ says Kay Bommer, managing director of DIRK, Germany’s IR society. ‘We went through a very steep learning curve. We took an academic approach, studying what others were doing and how we could do it right.’

He observes that Germans are known for their thoroughness, especially on the regulatory front. To illustrate, he points out that the Germans adopted the equivalent of Reg FD long before the Americans did. ‘When it comes to regulation, we’re unbeatable,’ he laughs. ‘Germans like to do things 150 percent.’

Gillian Karran-Cumberlege, a partner at London-based board development and executive search firm Fidelio Partners, previously headed group IR for Volkswagen, and agrees with Bommer’s characterization. ‘German companies tend to be very structured and strategic,’ she says.

‘They originally learned about [IR] best practices from the Anglo-Saxon capital markets, and they approached IR in a very systematic way. German companies are willing to allocate the resources they need to get the results they want – and they’ve applied that willingness to investor relations.’

Size matters

When Magdalena Moll, senior vice president of IR at BASF, joined the chemical company in 2003, she found a team of six within ‘a very young function’.

Recruiting well-trained IROs was an enormous challenge, so she began luring BASF senior managers with years of business experience into the IR function for four-year stints. While this model means constantly training newcomers, it has its distinct advantages.

‘When these managers go back into the business, they take all this capital market know-how they have compiled with them, and they are the best messengers for IR in operations,’ Moll says.

Today, BASF has a 14-person IR team – impressive even by German standards, but still comparable to several of its DAX peers. Bommer estimates that most DAX companies have anywhere from five to 20 employees dedicated to IR.

And even many mid-cap companies boast a wealth of IR talent. Lanxess, which won IR Magazine’s mid-cap grand prix in 2010, 2011 and 2012, has an IR team of six.

Magdalena Moll picks up the grand prix for best overall IR at the IR Magazine Awards – Europe 2013

On the other hand, Wolfram Schmitt, head of IR at Hannover-based Talanx, a major insurance group, contends that while German IR teams are often large, size is not what distinguishes them. ‘Even if a team has 20 people, they’re not all entitled to speak to investors,’ he explains.

He notes that bigger teams have many junior people tasked with special jobs, such as preparing presentations and other quasi-administrative tasks. ‘I don’t think there’s a direct correlation between headcount and quality,’ he says.

Karran-Cumberlege points out that German IR departments grew up differently from their UK counterparts because they did not inherit the highly developed broker relationships that are a feature of British companies.

‘Teams are smaller in the UK because the brokers, in effect, were part of the eyes and ears of the company regarding the markets and shareholders,’ she says. ‘In Germany, IR has always been a core in-house function.’

The numbers bear this out: according to IR Magazine’s global IRO survey 2012, which canvassed the views of more than 1,200 IR practitioners, German companies are less likely to outsource strategically critical IR functions.

For instance, only 13 percent of German companies with IR teams responsible for targeting outsource this responsibility, compared with 27 percent in Europe as a whole. Similarly, 18 percent of German companies outsource roadshow meetings, compared with 33 percent throughout Europe.

‘Outsourcing doesn’t happen too often in Germany as IR is viewed as a strategic function within the firm,’ explains Bommer. He is convinced this do-it-yourself ethos contributes to German companies’ success.

A broader role

Elmar Baur, director of IR at Kabel Deutschland, an MDAX cable operator, heads a three-person team with a part-time assistant. Even though his IR team is not extensive by German standards, the company does both fixed income and equity IR and manages the company’s ratings agency relationships. Having a hand in so many projects is an asset for an IRO, says Baur.

He likes knowing when a refinancing may be on the horizon, or being able to keep equity investors abreast of what’s happening at the ratings agencies.

The types of issues members of the IR team tackle often depend on industry. At Talanx, two IR managers within a six-person team are responsible for managing the ratings agencies. ‘In insurance or banks, you don’t have only one rating but 12 or 15 within the group,’ Schmitt says. ‘It’s of the utmost importance to get a good rating for the business model.’

Moll observes that all her IR managers are responsible for a specific corporate segment, as well as a branch of IR, such as retail investors, debt or sustainability. And of all the additional competencies, sustainability may be the one that has given German IROs the greatest edge.

Moll believes hosting sustainability roadshows in Europe and working closely with the company’s internal sustainability experts ‘is definitely an advantage in our communications with investors.’ Karran-Cumberlege further notes that as companies everywhere broaden their focus on stakeholders, many German companies enjoy a distinct advantage because this has long been their habit.

Rather than branching out into other corporate disciplines, some German companies are using their added headcount to extend their geographic reach. For instance, Volkswagen has a 13-person IR team and, as well as headquarters in Wolfsburg, the car maker has IR offices in London, Beijing and Washington, DC.

No matter how a company chooses to expand its IR function, a more inclusive definition of investor relations can prove a terrific boon. ‘IR is not primarily about being a speaker for the company, but being an ear to the market,’ says Bommer. ‘IR needs to catch the sentiments out there, and reflect them back into the firm – making the IRO an adviser for the board.’

Healthy competition

IR’s location on the organizational chart is one possible indicator of the prestige of the function. Moll, who reports directly to BASF’s chairman and CEO, says, ‘I get firsthand information from the CEO, and I’m also closely linked to the CFO. I think this really shows the commitment of senior management.’

Schmitt also reports to the CEO, a relationship he says ‘empowers’ him and gives him ‘greater credibility’. He points out that the CEO consults him before and briefs him after board meetings, thereby injecting the IR perspective into boardroom discussions.

Oliver Stratmann, head of IR at Cologne-based chemical giant Lanxess, believes reporting to a board member is critical for IR success. ‘If you don’t have your finger on the pulse of top management, it limits your ability to do a good job,’ he says.

German IROs also seem to fare admirably when considering the classic touchstone of success: compensation. Karran-Cumberlege notes that while IROs at top European companies are well remunerated, German IROs ‘have pulled ahead’ on this score.

So perhaps it’s no coincidence that German IROs tend to stay in their positions longer than their counterparts elsewhere. ‘If you look at many of the senior officers in the DAX, they’ve often been in IR – and in that particular IR role – for quite some time,’ she says.

German IROs with impressive tenures are easy to find. Torsten Schuessler, head of IR at BMW Group, has been in his current role for 12 years, and Moll in hers for 10. Baur, who’s worked in IR at Kabel Deutschland for nine years, maintains longevity is a huge plus. ‘If you have a long-standing relationship, you know the firm and people know you,’ he explains.

Schmitt, who describes himself as part of ‘the old guard’, having spent around 17 years in IR, believes German executives have a competitive streak that spurs them to higher achievement. ‘We all meet at investor conferences, and there’s a competition about who’s the best CEO or CFO when it comes to capital markets communications,’ he says.

Finally, Stratmann points out that DIRK is a terrific resource, allowing German IROs to exchange ‘ideas and best practices’. And Schuessler explains that IR professionals within the DAX benefit from a working group that meets twice a year: ‘We share experiences and knowledge, and we work well together. I think this makes German IR even stronger.’

Staying ahead?

German firms have arguably parlayed a penchant for thoroughness into unparalleled IR practices. The flip side of this, says Bommer, is that Germans are occasionally slow to adopt new technologies, waiting for ironclad proof of success before embracing new ideas. ‘We sometimes miss trends,’ he admits.

‘When you look at the social web, we’re behind what the US is doing.’ But he adds that even within the online area, German companies are poised to pounce should new social media outlets prove sufficiently compelling.

Proceeding with caution can yield tangible benefits, however. German IR professionals, for instance, have taken best practices from abroad and adapted them to their own needs.

Moll, who got an MBA and worked in the US for eight years before launching her IR career in Germany, says she used strengths she borrowed from American businesses – specifically, a customer orientation and the courage to experiment – to develop her IR team at BASF.

Many German IR practitioners downplay their own accomplishments, maintaining that IR excellence abounds in companies everywhere. ‘I’m of the opinion that you find very good investor relations in all regions of the world,’ says Moll.

In the end, though, even this modesty is tinged with pragmatism and a realization that just as German companies piggybacked off UK and US IROs, their best ideas are now ripe for plucking by others.

‘A few years ago, the UK teams had all the best practices in IR but since then several British IROs have moved to the continent,’ says Schmitt, noting that these types of high-profile, cross-border personnel changes have led to a kind of cross-pollination within the IR discipline.

In IR and elsewhere, he concludes, ‘the United States of Europe is starting to be seen.’