Neil Stewart checks in on the latest options for employee share ownership plans

From the C-suite to the shop floor, employees have an array of ways to share in their company’s success – options, stock grants or buying shares at a discount. But as anyone knows, being heavily invested in a single stock is not for the faint of heart.

Following a decade that incorporates the dotcom bust, Enron’s disastrous fall, a worldwide financial crisis and a debt crisis that is still unfolding, it is reasonable to ask: has the world soured on employee share ownership?

The short answer is that employee share ownership is still seen as an important part of corporate culture. It is seen as a way of encouraging productivity, boosting morale and eventually increasing personal wealth.

But years of middling or negative returns – and the stomach-churning volatility of late – have cooled employees and companies alike toward making an equity stake too big a part of their compensation. And this has led to a measurable decline in broad-based, long-term incentive grants.

For executive management, though, equity is still a key part of compensation, helping companies to compete for talent while aligning management and shareholder interests.

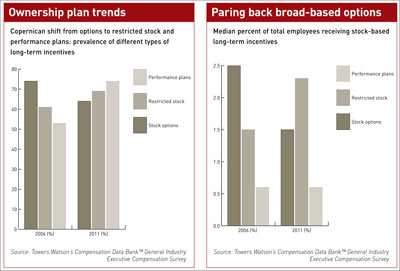

There have been significant shifts, however, such as a move to grant stock outright rather than grant options to buy, or being more selective with dwindling remuneration budgets, or tying stock grants to performance.

Through it all, employees and executives alike are keen observers of companies’ stock performance, which means the investor relations team, in tandem with the communications and human resources departments, play to a tough internal crowd.

From exuberance to realism

The 1990s were the heyday of broad-based stock compensation, especially in the US. Then the dotcom crash wiped out a lot of paper millionaires, as did Enron and other scandals.

The Enron effect, 10 years laterEver since the demise of Enron, which took many of its employees’ life savings down with it, companies have been hesitant to prevent employees from selling company stock. The main lesson from Enron, says Joseph Blasi, a professor at Rutgers University, is that companies must educate employees about the risks of different types of employee stock ownership.‘Enron aggressively pushed workers to buy company stock with their savings and continued to push them even as the company was falling apart and senior managers were offloading their stock,’ he says. While Enron hawked its own stock to employees, it showered upper-level management with options, which didn’t have nearly the same risk. ‘It should have been the opposite,’ Blasi says. Enron’s disintegration in December 2001, in the midst of the dotcom bust, underpinned the trend away from putting company stock into retirement plans. ‘US companies these days communicate a lot more to employees about not loading up their 401Ks [pension plans] with company stock,’ points out Michael Keeling, president of the ESOP Association, a trade organization. Citigroup is another cautionary tale. Sanford Weill, who led Citigroup until 2006, became famous for promoting employee stock ownership, partly to cement loyalty after his many acquisitions. But Citigroup’s stock price infamously fell from nearly $60 to below $1 in the wake of the financial crisis. (In May 2011, Citigroup did a reverse one-for-10 stock split, so although its shares were at around $30 this autumn, that was equal to about $3 in old shares). Citigroup was a target in the recent flurry of ‘stock-drop cases’, which are lawsuits brought by employees, especially those in financial services companies that were hit hard by the 2007-2008 financial crisis. These cases are almost always won by companies, even though the Obama administration has voiced sympathy for employees, Keeling notes. |

Options, along with other forms of equity-based compensation, started to go out of fashion for the ordinary employee. Since the middle of the last decade, the trend away from broad-based equity grants has accelerated.

‘Companies found out that individuals didn’t value equity as much as they did cash, that dilution was a concern and that communication about the value of equity – particularly stock options – is always a challenge,’ says Doug Friske, global leader for executive compensation consulting at Towers Watson, a human resources consulting and risk management firm.

There is an obvious reason for companies easing up on giving employees equity. ‘Stocks go down and they don’t tend to go up so much anymore,’ explains Jonathan Ocker, a San Francisco-based partner at law firm Orrick Herrington & Sutcliffe.

Most companies today don’t want to put a stock fund into a retirement plan because of the risk of failing in their fiduciary responsibility. Alternatively, if they put their own stock in their plan, they include plenty of protection so employees aren’t stuck holding the stock.

Shareholder pressure, including the fight against dilution, has also eaten away at equity compensation. For example, ISS, the influential company that facilitates and advises on institutional shareholder proxy voting, applies a ‘shareholder value transfer’ test: if a company tries to transfer too much equity to its employees, ISS will recommend a vote against its pay plan.

So an issuer whose pay plan is coming up for a vote may ask, for example, whether a cash bonus would make better sense for overseas employees, especially taking into account the compliance costs and regulatory hurdles involved in many emerging markets.

Sharing the ups and downs: case studiesMicrosoftMicrosoft pioneered options for employees in the 1980s and 1990s, then paved the way again with a wholesale switch to restricted stock in 2003. Many employees also hold Microsoft shares in their retirement plans and have access to a stock purchase plan. A rough estimate puts ownership among the company’s 90,000 employees at around 3 percent of Microsoft’s $200 bn-plus market capitalization. Two or three times a month, an IR team member can be found speaking to an ‘all-hands’ division meeting. ‘I get hard questions from these guys – one person had no hesitation telling me I wasn’t doing a good job,’ laughs Bill Koefoed, Microsoft’s IR chief. Then there are the popular Street Talk videos. After big investor events such as financial analyst days, Microsoft’s CFO Peter Klein grills an analyst or fund manager. A video of the conversation is posted on Microsoft Web, the company’s intranet portal, along with special earnings recaps for employees. BASF BASF’s incentive shares program is a half-century old and 25 percent of the German chemical company’s shares are in the hands of about 400,000 retail investors, many of them employees. About 40 percent of visitors to BASF’s IR website come from within the company. Andrea Wentscher, the IR executive responsible for retail shareholders, says they are heavy users of an investment calculator as well as a service that sends the closing share price by SMS. BASF’s IR team covers a variety of topical and educational themes in the company newsletter – recently, for example, it featured an interview with the head of IR on dividends, and a look at how BASF achieved its spot on the Dow Jones Sustainability Index. Investor relations forums for employees are held twice a year, once in Germany and once somewhere else. Often, a financial analyst is also invited to speak about the perception of BASF’s stock. Covidien Covidien, a Mansfield, Massachusetts-based medical device maker (spun off from Tyco, the conglomerate, in 2007) has an employee stock purchase plan, as well as stock options, restricted stock and shares that are tied to total shareholder return against a peer group. ‘We’re constantly asking: do we have the right mix? Do we have the right metrics?’ says Mike Dunford, senior vice president of human resources, who works closely with the investor relations and corporate communications teams to coordinate shareholder communications for employees. A couple of days after each quarterly earnings announcement, several hundred employees gather for a big meeting. CEO Joe Almeida runs through the results and introduces a leader from a specific business to talk. The most recent meeting had a special presentation by the head of Covidien’s emerging markets business and was broadcast live to about 16 locations, with a video replay posted on Pulse, the company’s intranet. |

‘Around the globe, we’re seeing much less stock being doled out,’ Ocker says, although he adds this caveat: ‘China is an exception. It’s the new California.’ As it happens, California is still California in the stock-grant sense.

Silicon Valley start-ups typically rely heavily on pools of stock to attract talent, often as much as 30 percent of a company’s share capital. ‘It’s 1999 all over again,’ says Bill Koefoed, Microsoft’s head of investor relations. ‘Employment in technology is crazy just now and stock-based compensation is super-important. It’s how you get to be a ‘kajillionaire’.’

Top guns singled out for stock

At senior management level in other industries, equity grants have been pared back, salaries held flat and bonuses axed amid post-crisis austerity. Executive equity compensation in general is holding steady, however, and there are some cases where it is increasing dramatically.

The reason? Companies are selectively rewarding high performers at the expense of others. ‘They’re more surgical about their compensation practices,’ says Ocker. ‘Instead of spreading stock around like peanut butter, they pick and choose who to reward.’

Boards and shareholders alike want to see the executives’ and the company’s interests aligned. But now a stock grant is preferred to options – typically in restricted stock, which can’t be sold for a period of time.

A big driver was the change in US GAAP rules in 2006 that forced options to be counted as an expense, eliminating one of their biggest advantages.

The transition from options to stock has been good for executives. Straight stock may not have the same upside as a low-priced option, but it does have more downside protection: even if the stock price goes down, there will be something left in the employee’s pocket.

From the shareholder’s perspective, there’s more alignment with restricted stock because an executive with underwater options doesn’t really care if his or her stock is $5 or $50 below the exercise price – the options are worthless either way.

Plus, restricted stock typically costs the company less and dilutes shareholdings less; the rule of thumb is that one share equals three options.

Click to enlarge

Linking to performance

There is another accelerating trend, especially since the financial crisis: tying compensation to performance, with shares granted when certain goals are met, such as increases in operating revenue, earnings per share or some other measure of total shareholder return.

This has inevitably reduced the amount of stock being given out, perhaps by as much as 20 percent in the last five years, Ocker believes. Europe is ahead of the US in this area.

According to Mercer’s Global Financial Services Executive Incentive Plan Snapshot Survey, published in July 2011, 88 percent of European companies have long-term incentive stock awards tied to performance, compared with only 50 percent of US firms.

Some 75 percent of European companies’ option plans have performance clauses, whereas none do in the US. Looking ahead, companies are likely to be even more conservative with equity compensation because of the wild volatility in world markets, which puts stock prices even further outside the control of both management and employees.

‘Broad-based equity participation will shrink even more,’ Friske concludes, although he doubts that equity grants for top executives will be pruned. ‘Shareholders might say, We’re getting queasy, so why should senior management be let off to settle their stomachs?’

The trend toward granting shares to senior executives will continue. The big question, however, is how companies will set those performance goals given that most don’t know what’s going to happen during the next six months, never mind the next three or five years.

This article originally appeared in the Brunswick Review.

What can Big Brown do for its shareowners?United Parcel Service (UPS), the Atlanta-based package delivery company, is almost as well known for its ‘ownermanager philosophy’ as it is for its brown trucks. From its founding in 1907 until its initial public offering in 1999, when it sold 10 percent of its equity to the public, UPS was owned by its employees. Today, about 35 percent of its equity is in the hands of current or former employees.Andy Dolny, vice president of treasury and IR at UPS, has been with the company for 30 years, a typical tenure in a firm with a high level of loyalty. Stock forms part of many employees’ compensation, with a stock purchase plan open to everyone. Purchases of UPS stock for pension plans are matched by the company and about 35 percent of drivers and 100 percent of management own UPS stock, Dolny says. UPS encourages its employees to listen to its quarterly earnings calls, which are posted on an employee internet portal. Dolny also holds ‘town hall’ meetings with the leaders of UPS’ domestic and international businesses on the days quarterly earnings are announced so they can take the feedback from analysts to the whole company. ‘I’m really speaking to them as employees of the organization,’ says Dolny. ‘At the same time, however, I’m mindful of my role as an investor relations officer and their role as investors.’ With its long history, UPS pays a lot of attention to retiree shareowners as well as descendants of its founders. The IR team organizes two or three webcasts each year specifically for retired employees and meets them in person about three times a year. It also has up to 10 meetings a year for the founding families. Dolny emphasizes that UPS’ IR, PR and internal communications are closely aligned. The other functions report to a senior vice president of communications and he reports to the CFO. |