A series of announcements last week provided the tipping point for European asset managers, forcing some that previously expected to charge clients for research to change policies.

Under Mifid II, it will be the norm for asset managers to pay research costs from their P&L and it is likely other managers will follow what is now the dominant trend. But there is fine print to many of these decisions that has been largely overlooked by the media. It appears all of the US-based asset managers and at least one of the European managers announcing they will pay for research from their own pockets have limited their policies to clients subject to Mifid II. This creates some interesting dynamics.

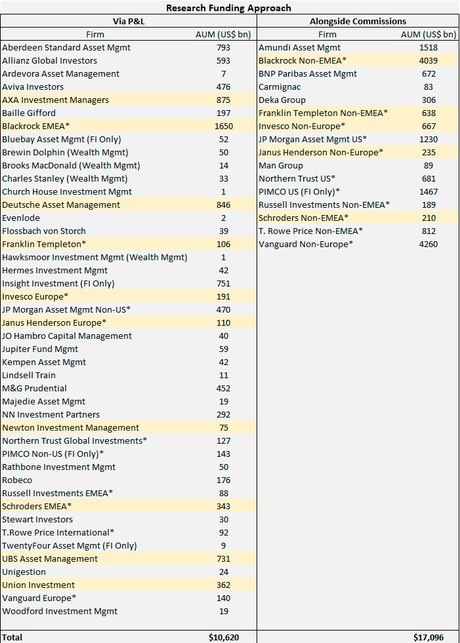

Funding scorecard

We list below the asset managers that reportedly have decided to pay for research from their P&L under Mifid II.

Source: Integrity Research

This shows 44 asset managers that are reportedly planning to fund research from their own resources, clearly a dominant majority. But 11 of those firms (asterisked) appear to have ring-fenced their obligations, in most cases explicitly stated in their press announcements. In other words, the firms will waive research costs for clients subject to Mifid II, while continuing to fund research payments alongside commissions for the balance of their clients.

For the 11 firms that have adopted one policy for Mifid II clients and another for non-Mifid II clients, we show estimates for the assets associated with Mifid II versus the assets that will continue to be funded alongside commissions. For example, JPMorgan Asset Management, which was careful to state that its payments for research would apply to ‘Mifid II client accounts’, had US assets totaling $1.23 tn of its $1.7 tn global assets under management as at August 2017. We have attributed the full $470 bn its non-US assets to its P&L funding decision even though the number includes non-EMEA assets, pending additional details from JPMorgan.

Because non-EMEA assets greatly outweigh EMEA assets for the global asset managers that will ring-fence their research payments, assets associated with research payments funded alongside client commissions greatly outweigh Mifid II assets where research will be subsidized by the asset manager.

US-based managers

BlackRock, which as at end of June 2017 sourced 29 percent of its $5.7 tn in assets under management from Europe, said it would pay research costs for Mifid II-impacted funds and client accounts. Only 28 percent of BlackRock’s global assets are actively managed, which suggests BlackRock’s actively managed EMEA assets are around $460 bn, on a par with M&G Prudential’s assets under management. That’s a drop in the bucket for an asset manager that garners more than $10 bn in fees annually.

BlackRock made a point of referencing its internal research capabilities, which includes more than 300 professionals, according to the asset manager. It said it was committed to developing its in-house research ‘while ensuring our teams retain access to external research that adds value to the investment process.’

Franklin Templeton, with European assets of $105.5 bn out of $743 bn total assets under management as at the end of June 2017, said it will pay for third-party investment research for client accounts covered by the new EU rules. According to regulatory filings, separate accounts managed from Franklin Templeton’s UK subsidiary consisted of just under $39 bn as at the end of March.

European managers

AXA Investment Managers, the €735 bn ($875 bn) asset management arm of the French insurer, said it would also absorb research costs globally. As at the end of last year, only 10 percent of AXA’s assets were in equities, making the decision easier given that funding research payments alongside commissions is not an option for fixed income assets.

Deutsche Asset Management, the €711 bn fund management arm of Deutsche Bank, also announced it would absorb research costs globally once Mifid II comes into force. As at the end of June, two thirds of Deutsche’s assets were European. In its press release the company emphasized it would ‘negotiate with its third-party research providers to optimize costs’ but did not give a figure for its expected research costs.

UBS Asset Management reportedly also decided it would pay for research from its own resources. As at the end of June, the unit had CHF703 bn ($731 bn) in assets under management, of which 56 percent were European and 36 percent were invested in equities.

UK-based Newton Investment Management, a £55 bn ($74 bn) subsidiary of BNY Mellon, also announced it would pay for research from its P&L.

Switching sides

The avalanche of announcements prompted Schroders, Invesco and Union Investment to reverse their decisions to fund research payments alongside commissions. BNP Paribas Asset Management was also said to be wavering and will likely announce it will pay for research from its P&L.

Schroders noted in its press release that it does not currently pass along research costs for its fixed income or quantitative products, perhaps subtly referencing passive managers like Vanguard or fixed income managers like Pimco, which historically had little, if any, research expenses and are unlikely to have much in the way of research costs under Mifid II.

Schroders said it would pay for research for its clients subject to Mifid II, similar to the ring-fenced approach being taken by US-based managers, while ‘giving due consideration to applying this approach to other jurisdictions.’ It referenced its 120 equity research analysts and ‘an increasing proportion of our in-house budget in data science to capture market signals and intelligence to make us better investors.’ Schroders was one of the first long-only asset managers to set up a separate alternative data unit.

UK regulators have prevailed

There is no question that the increasingly unanimous decision to fund European research payments from the P&L is momentous, with important implications for the asset management industry, research providers and vendors associated with the research space.

Historically, global asset managers have striven to adopt policies globally, seeking consistent operations across the various domiciles where they operate. Initially, nearly all global asset managers were planning to fund research payments alongside commissions because that seemed the most globally consistent funding approach. Jawboning by UK regulators and a frenzy of UK media attention helped to tip the scale toward the solution preferred by UK regulators: paying for research from the P&L.

As a result, we now have two starkly different regimes that will create some unintended consequences for asset managers and research providers. By ring-fencing Mifid II research payments, US-based asset managers now enjoy added economies of scale relative to their European counterparts. Research costs are subsidized under US law for the bulk of their assets, whereas European asset managers suffer reduced profitability.

European asset managers can respond by promoting research savings to win share from US asset managers that are passing along research costs to US asset owners. But Oliver Wyman estimates that research costs make up on average only 1 to 3 basis points of the total charges of active managers, and those costs will be lower the larger the asset manager.

This is a scenario French regulators were seeking to prevent when opposing the more stringent unbundling rules championed by UK regulators. UK regulators have prevailed and now research industry participants have to contend with the fallout.

Sanford Bragg is principal of Integrity Research Associates, an advisory firm focusing on the analysis of the global investment research industry