Investor and analyst perceptions of the UK leaving the EU

|

At a glance Sector effects Break-up talk |

Sir Tim Barrow, the UK’s ambassador to the European Union, confirmed his country’s intention to leave the club of 28 European nations by handing over a signed letter in March. The move set off a two-year timetable for completing Brexit, but few other details are clear.

There remains little certainty over how the negotiations between the UK and the EU will progress. Brexiteers and Remainers continue to clash over the benefits and costs of the decision to leave. And uncertainty hangs over the role of London as a financial center, with other European cities keen to pinch its business.

To gauge the investment community’s mood at this time, IR Magazine asked around 150 portfolio managers, buy-side analysts and sell-side analysts from across Europe to give their views on several aspects of the UK’s intention to leave the EU, and the potential impact this will have on both EU countries and the UK.

Impact on European stock markets

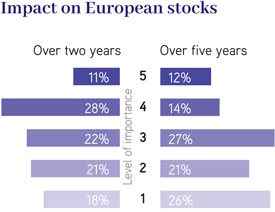

First we asked respondents to rate – using a scale of 1 to 5 where 1 is ‘low importance’ and 5 is ‘high importance’ – how important Brexit will be for European stock markets in both the medium and the long term.

Thirty-nine percent of respondents rate the impact of ‘high importance’ during the next two years compared with 26 percent using the same ratings for the impact in five years’ time. A further 13 respondents said it was too difficult to make any predictions on possible outcomes until negotiations had progressed. Although views vary as to how large an impact Brexit may have and on the length of time before the impact is discernible, most agree the situation is currently highly uncertain.

Around 10 percent of the respondent base comment that the impending European elections and the situation in the US are of more concern than Brexit.

Selected comments

The impact of Brexit

‘It will take at least two years to see the impact, so the short term is not an issue’ – Germany, sell side

‘The next two years are of high importance because of the uncertainty but as time goes by we will begin to understand the mechanisms of Brexit’ – UK, sell side

‘Everything is going to be very slow and even five years might be a bit too soon to feel the full impact’ – UK, sell side

‘It is impossible to quantify the final outcomes while it is still under negotiation’ – Germany, sell side

‘Who knows? It may have very little effect’ – Italy, sell side

Europe elections and the impact on the EU

‘It will be a big problem in a few years and Brexit is probably a catalyst that will break up the European Union. Other countries might leave. Brexit is just the beginning’ – Hungary, sell side

‘We will have bigger and more concerning problems within the EU within two years’ – Italy, sell side

‘Europe has elections quite soon that might make Brexit appear less important’ – Italy, sell side

‘All will be in limbo until after the French election’ – Austria, buy side

‘The reaction in France is critical and so much depends on the election. If the extremists get in, there will be even more nervousness and more countries may leave the EU’ – Sweden, sell side

US of more concern

‘It will be more important when exit discussions gain speed but US policies are of much more concern than Brexit’ – Germany, buy side

‘Now that Donald Trump is in the picture… ’ – Netherlands, sell side

‘The upcoming European elections add to the risk that the situation in the UK and the US have started. I am not sure the UK is any more at risk than the rest of Europe’ – Norway, buy side

The effect on sectors

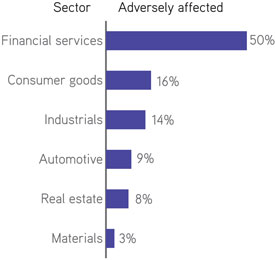

We then asked respondents for their views on which sectors would be the worst affected. Half the respondents think the UK’s financial services sector will be adversely affected.

Selected comments

Worst-affected sectors

‘The hardest hit will be financials and real estate. Although they both depend on agreements drawn up, all sectors depend on the financials sector so there are implications for them all’ – UK, buy side

‘The financial sector will feel the brunt of it as it will have a big impact on major banks, brokers and hedge funds. There is no doubt it will be disruptive but also very interesting’ – Germany, sell side

‘A lot will change in the banking sector as there will be relocations to continental Europe’ – Germany, sell side

‘Brexit has hit the pound hard and this has severely impacted Italy’s luxury goods market as the Chinese and Saudis flock to the UK rather than Italy. Meanwhile, UK luxury goods companies have had to put their prices up to retain their luxury status’ – Italy, buy side

‘In the short term it will impact companies that import, such as retailers. In the medium term, capital investment may well be affected, especially at companies like Airbus and GKN’ – Sweden, buy side

Only a few respondents had a view on which sectors would be least affected as several pointed out that all or most sectors would feel an impact. Four respondents said the healthcare sector would fare better than most and four respondents said the utilities sector would not be affected.

Selected comments

Least-affected sectors

‘Healthcare & mining’ – Austria, buy side

‘Utilities are self-contained so will not be affected’ – Finland, sell side

‘For healthcare companies, the UK will remain an important market and UK pharmaceutical companies will negotiate good terms with EU members. I see no dramatic changes and we’ll have to see how the UK will adapt to any new laws on, for example, clinical trials’ – Denmark, sell side

‘Biotechnology and pharma are more protected’ – UK, sell side

Selected comments

Positive attitude

‘I am confident Brexit will have a positive impact on the UK although obviously it depends on the trade agreements that are reached. The economy is flexible and it’s too early to see the implications of the banks downsizing’ – Finland, sell side

‘It’s an opportunity for the eurozone to put in place new laws and reforms. It will be more of an opportunity than a setback’ – France, buy side

‘My firms will not feel any effect as they are not tied to the UK’ – Austria, sell side

Talking to companies

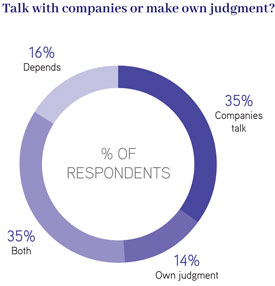

The survey further asked respondents whether they wanted companies to talk to them about these issues or would prefer to rely solely on their own judgment.

The majority of respondents want to hear companies’ views in conjunction with using their own judgment. Many companies are happy to have the conversation with investors and analysts, even if the outcomes are still unclear. Some companies are less prepared to talk, however, as they continue to assess the situation.

Selected comments

Companies happy to talk

‘Everyone is talking about it; it’s a widespread theme but it is difficult to do any more than speculate at this stage’ – Germany, sell side

‘I have already talked to most of the senior management teams at my companies and the general opinion is rather negative in the long term. We expect a decline in the overall picture, although that picture is not very clear’ – Germany, sell side

‘I form a lot of my opinions on the basis of what companies say in meetings. I am very interested in hearing their plans’ – Switzerland, buy side

‘Yes, we absolutely need to talk to companies. We need to know the historical implications and the changes in prices and materials. I can then use this information to make my own judgments’ – UK, buy side

‘I want to know how they are approaching it from both the financial and operational point of view’ – Spain, sell side

Companies not talking

‘We try to discuss the situation with companies but they are reluctant because, without a framework, it is only speculation. BMW, for example, has a lot of plants in the UK but at the moment it is not saying anything’ – Germany, sell side

‘Right now most companies don’t know what to say but when they do I would like to hear their views’ – UK, sell side

‘Initially companies talked about making arrangements to avoid the outcome; more recently they have held back and become more prudent’ – Sweden, sell side

‘Of course I am interested in their views but so far absolutely no comments have been made by any of my auto companies’ – Germany, sell side

‘We are all in the dark at the moment so I don’t think even the companies have much to say’ – Ireland, sell side

Own judgment

‘Companies seem to be interested in the short-term effects and we prefer to make our own judgments’ – UK, buy side

‘I only want to know if there’s a change in their investment structure’ – Portugal, buy side

‘The track record over the last seven to eight months suggests the City and companies everywhere just don’t know. They should stick to what they know, unless there is a specific effect on their business’ – Ireland, sell side

City of London

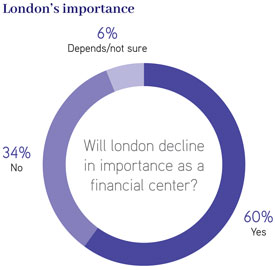

We asked respondents whether they expect London to become a less important financial center. They were given two options: yes or no. The majority of respondents say yes, London will become a less important financial center. But 16 percent of respondents who say yes go on to say that the reduction in importance will be only marginal.

We asked respondents who think that London will become a less important financial center for their views on which European cities would benefit, and those most frequently mentioned are Frankfurt (40 percent of respondents), Paris (27 percent) and Dublin (13 percent).

Also mentioned are Madrid, Milan, Warsaw and Zurich, which notch up 8 percent of the vote between them. A further 6 percent of respondents say it is more likely that the effect will be multi-centered and several cities will share the benefits.

Selected comments

Less important

‘London will not become less important from a fund management point of view but may well do from a capital markets viewpoint as companies relocate to Europe’ – Germany, sell side

‘I think it will become more multi-centered, with relocations to a number of European cities, so many will benefit’ – Germany, sell side

‘The focus will shift to continental Europe, probably Paris, Frankfurt or maybe Dublin’ – Germany, sell side

‘I think London will be become less important and a German-speaking country may well become more so’ – Switzerland, sell side

‘Several different cities across Europe will become more important as London’s dominance diminishes’ – Austria, sell side

Slightly less important

‘London will be slightly less significant as a result, and Paris and Dublin will share the focus. And perhaps Frankfurt, too’ – Germany, buy side

‘The City of London will become less important to non-British companies’ – Switzerland, buy side

‘London will be slightly affected but that is not a bad thing as it’s not healthy for one center to be so important in the first place’ – Belgium, buy side

‘London may lose 20 percent of staff from investment banks but it will remain a big financial center’ – Belgium, buy side

‘London will probably become a tiny bit less important’ – UK, sell side

No change

‘The City of London is not something that can be recreated elsewhere’ – Italy, sell side

‘London still has cache and people want to live there, especially those in financials’ – UK, buy side

‘My perception is that London will remain a strong financial hub. It is such an important story, why would anyone destroy it?’ – Sweden, buy side

‘I don’t know. It may not have the impact we expect’ – Spain, sell side

‘Yes, in theory! But in practice the City will always be the City, so London will most likely remain as important as during the last 300 years’ – Portugal, sell side

|

Picking the best IR performers in Europe The research for this article was undertaken at the same time as the survey for our IR Magazine Awards – Europe 2017. Each year we poll hundreds of investors and analysts to uncover the best IR performers across the region. The winners will be announced at a gala awards night on June 21 in London. Around the same time, we will release the IR Magazine Investor Perception Study – Europe 2017, which contains ranking information for hundreds of companies across different IR categories based on the votes of investors and analysts. For more information on ourresearch, please follow this link. |

This article appeared in the summer 2017 issue of IR Magazine