A roundup of academic research from the world of IR studies

If you’re looking to attract a base of sophisticated investors, you should regularly issue earnings guidance and consider pulling back on IR and press dissemination.

If you prefer less sophisticated investors, however, a series of Columbia University studies finds these are more prevalent in firms that spend big on corporate advertising and have superior IR.

Alon Kalay, assistant professor of accounting at Columbia Business School, says research shows the composition of a company’s investor base has implications for the liquidity of its shares and for a range of corporate decisions, such as the optimal payment method in a merger.

Kalay has developed an innovative options trading-based measure of investor sophistication, which he uses to document a disclosure ‘clientele’ effect.

‘The idea is that different types of disclosure activities differentially benefit investors with varying levels of sophistication,’ he says.

‘That means the right changes to a firm’s disclosure policy have the ability to change the sophistication of the investor base. If you’re doing a good job at IR, for example, you can attract less sophisticated investors who value IR’s help in processing and accessing data.’

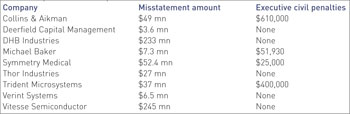

World o’ research- A study of 39 recent civil lawsuits brought by the SEC suggests financial fraud may be worth the risk. Here’s a representative sample of the cases examined: ‘Often the final judgements impose penalties seemingly disproportionate to the misstatement amounts,’ writes study author Maria Babajanian in a University of South Florida honours thesis. She suggests harsher penalties and more immediate punishment would better deter fraudsters. - Less visible tech firms that Twitter links to company-initiated press releases get tighter bid-ask spreads and greater depth, say researchers at Stanford and the University of Michigan. |