Veterans of activist campaigns explain how to run a vulnerability assessment and put a response plan in place

As investor activism campaigns become more commonplace – and better publicized – companies are increasingly running vulnerability assessments to identify potential fault lines and putting a plan in place before an activist surfaces. But where do you start – and what should you be looking for?

Ed Bridges, FTI Consulting London

‘What you need to do is front-load so that you’re doing what you frankly should be doing anyway: communicating well,’ says Scott Hopkins, a partner in law firm Skadden Arps Slate Meagher & Flom’s London office. ‘Having a well-performing share price is always the best way to deal with [activism]. But you also have to be out there communicating with the constituencies that are important: your shareholders, the analysts, the press. If you wait to start communicating until you’ve had an activist pop up and start a campaign against your management, you’re obviously going to be seen as being defensive.’

As well as being sound business practice, regular communication also means that if a shareholder does start making noise, ‘you know who the people are you need to speak to, and they know you and you speak to them on a regular basis – not just because you’re feeling threatened by an activist, but because you do things properly,’ explains Hopkins.

And it’s not just the shareholders that count, either. Ed Bridges, senior managing director at FTI Consulting London, says you also need to think about the proxy companies that are advising your shareholders. ‘Ask yourself: Am I seeing these proxy advisers as frequently as I should? Am I treating them as a de facto institution? Do they really understand my corporate strategies?’ he recommends.

As well as advising your shareholders to support you, putting in the work with the proxy firms means that if ‘an activist comes calling, the proxy advisory firm will really understand your company and [be able to] ask some meaningful questions of the activist,’ says Bridges.

IR is obviously an important part of this process. ‘A capable and dedicated IR program is essential,’ says Bruce Goldfarb, founder of Okapi Partners, the proxy firm that helped Starboard Value replace all 12 board members at Darden Restaurants in October 2014. ‘Proactive outreach and evaluation of shareholder feedback are key in assessing a company’s existing vulnerabilities, devising a plan to address them and ensuring no new vulnerabilities arise.’

Know your shareholders

Bruce Goldfarb, Okapi Partners

If you’re doing a good job on the first point, you should know your shareholders well. But this isn’t always the case. ‘We have gone into situations on both the activist side and the company side where we are surprised at how little communication is going on between boards and shareholders,’ says Goldfarb. ‘In many instances, boards are not even aware of who their largest shareholders are and how they might respond if an activist arrives on the scene.’

For Steven Balet, managing director at FTI Consulting New York, a vulnerability assessment is valuable only if it follows a perception study. ‘Normally this is done by a third party because you just get a more honest result,’ he points out. ‘You’re not going to be able to truly assess your vulnerability until you have a good, third-party, objective view of the firm itself.’

Getting to know your register well includes understanding how your investors vote and ‘how much weight they give to [the recommendations of] third-party proxy advisory firms,’ Balet adds. But you can’t stop there: you also need to know who’s on the earnings calls and where the questions are coming from. ‘You need to understand who you are talking to, because these people may be the activists that target you two years from now,’ Balet says.

He also believes in the importance of laying strong foundations. ‘When we have to go on the road, meet shareholders and convince them to vote a certain way, [the IR professionals] are the people who have the information that’s necessary to win,’ he says.

‘If [the IRO is] really good, you have a very good shot at winning; if he or she is not so good, you’re really behind the 8-ball because you don’t know what your investors are thinking.’

Express yourself

Communicating with shareholders, proxy advisers and governance committees requires that they really understand your mid to long-term strategy.

Steve Wolosky, Olshan Frome Wolosky

‘Ultimately, someone could come along and say, Why don’t we use that cash and pay special dividends?’ explains Bridges. ‘So you need to be able to say, No, my shareholders understand where we stand on a three to five-year basis. They understand that the return on investment in all these areas is going to be greater than a one-off bump to shareholders in a special dividend – or whatever the reason for the strategy happens to be.’

He suggests companies use corporate reports to convey strategy, explaining in their annual reports how their dividend policy fits into their broader capital allocation policy, for example.

Once you’re confident you know your shareholders, it’s time to look at your company from an activist’s point of view. ‘Get someone to think the unthinkable and measure the value that could be created by thinking the unthinkable,’ Bridges advises. ‘That’s a key part in understanding where your vulnerabilities are.’ He suggests companies run a corporate finance assessment to highlight any ‘alternative views that could be taken by someone looking to extract cash from the business or realize value from a breakup’.

Companies can also get a good idea of how an activist might seek to target them simply by ‘conducting a review of any issues that may have been highlighted in prior reports by proxy advisers,’ says Goldfarb. Above all, ‘try as much as possible to be objective,’ he adds, though he admits this is easier than it sounds.

Be prepared

While IR is an important aspect of being prepared for activism, Steve Wolosky, partner and chair of Olshan Frome Wolosky’s activist and equity investment practice, says IROs (thankfully) simply don’t have enough regular experience of activism. ‘How does an IR person, who is generally used to dealing with day-to-day communications and routine discussions with shareholders, effectively deal with an activist?’ he asks. ‘[IROs] need to be involved in the process because they have the relationship with the shareholder base but I would be concerned if they were leading the [response] team.’

It’s critical to know whether someone could argue that the balance sheet is being underused or could be better used, or whether your company is a candidate for a breakup. And in order to really look at your company from an activist perspective, you often need to recruit an outsider. Undertaking this process could be seen as challenging the chief executive’s strategy, so Hopkins recommends first raising the issue internally in an emotionally intelligent way.

Once you’ve decided you want to look at it, he advises engaging an investment bank or law firm that has already developed screens that can be used to assess your vulnerability. ‘We do this on a regular basis so we know what the activist shareholders will be looking for and what the typical concerns will be,’ Hopkins says.

Outperforming your peers might well be the best defense against an activist, but ‘there are no sacred cows in the market,’ notes Bridges, citing Carl Icahn’s campaign against Apple. ‘Any company of any size, shape or reputation could be attacked.’

In a recent study by FTI Consulting – ‘2015 shareholder activist landscape: an institutional investor perspective’ – 76 percent of the 100 global institutional investors surveyed see the growth of activism in a favorable light, and 84 percent of them believe activism adds value to a target company.

Zach Kouwe, Dukas Public Relations

So even if you think your company is immune, Goldfarb says all firms could benefit from a look at where fault lines might lie. ‘Identifying potential vulnerabilities and enacting a strategic plan to rectify them is not only important in thwarting potential activism but is also sound business practice, because addressing any corporate deficiencies should ultimately enhance shareholder value.’

In addition to the tips above, you can take steps to ‘prequalify’ advisers you might need to call on – often at short notice. Meet with investment banks, law firms, PR agencies and proxy solicitation firms in advance to develop the relationships essential to combating a shareholder activist. Because you will be trying to cover a number of different bases, it helps to form a team that comprises members of your IR, legal, PR and corporate development/M&A departments, in addition to representatives from the corporate finance team and the CFO’s office.

Create a checklist

When putting a plan in place for a potential activist attack, it’s easy to lose sight of necessary day-to-day tasks. Taking care of little administrative details in advance, however, ‘allows the mechanics to operate so that people don’t spend their time running around trying to figure out what they should be doing as opposed to thinking about the real, core issue,’ explains Hopkins.

There are some key questions that can be asked ahead of time and roles that can be assigned, says Balet. He suggests:

- Who will talk to the activist?

- Which board members are going to be involved should it escalate to that point?

- How will you handle that initial engagement without divulging inside information?

- How can you engage productively with the activist and set the right tone?

Companies can also decide in advance who’s in charge of researching the activist and which sources to call, as well as the approach to take when dealing with a more aggressive activist, says Balet, who also suggests preparing holding statements. One often overlooked area, depending on how public the activist goes, is determining how you answer questions from employees, customers or suppliers, he adds.

Advanced planning can make a big difference in the early stages, Balet continues: ‘Your initial engagement with an activist investor sets the tone for how any future engagements are going to go and whether you can resolve [things] privately and without any pain for either party.’

With three quarters of the institutions in FTI’s research saying companies in Europe, Asia and/or Latin America would benefit from an increase in ‘US-style’ – or ‘more public and aggressive’ – activism, it’s important to have a clear policy for handling press queries. As well as developing relationships with the media in good times, a company could prequalify PR companies it wants on its side, as mentioned above.

‘Being unresponsive to journalists is never a good thing,’ says Zach Kouwe, vice president at Dukas Public Relations. It’s also wise not to ‘dig your heels in’, as this ‘not only looks unbecoming and defensive but also draws the media’s attention to the conflict aspect of the story rather than the validity of the actual ideas about long-term strategy.’

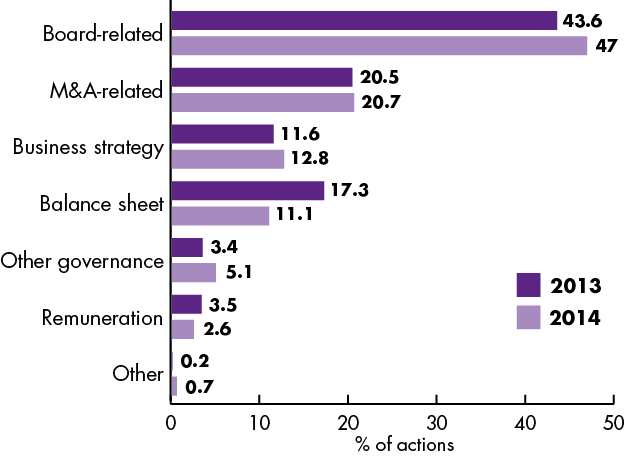

Activism isn’t only about the share price, of course. Last year, almost half (47 percent) of shareholder actions were related to the board, according to Activist Insight. That means it’s critical to evaluate your board, says Wolosky. ‘Constantly analyzing your board to ensure the right mix of directors and being proactive in bringing in new directors is important,’ he points out.

Source: Activist Insight

If you can’t or don’t want to recruit new directors, make sure your shareholders understand why those you have are crucial to the firm by highlighting their qualifications, experience and value – a tactic that will prove popular with the proxy advisory firms and shareholder associations as well.

Keep an open mind

As well as explaining how their current strategy is creating value for shareholders, ‘companies should be open to dialogue with activists, which often have interesting ideas and can be a catalyst for value-added change,’ says Kouwe. ‘This is important even if only to know how best to counter an activist’s proposals.’

Smart activists do their homework, spending time researching a company and becoming knowledgeable about its industry, says Wolosky. ‘To the extent that they aren’t knowledgeable, they bring in independent consultants and advisers to help them. They study the balance sheet, they listen to conference calls, they are generally smarter and better educated about the company than even the directors in many ways.’

Finally, running a vulnerability assessment – and even putting together your response plan – should never be a one-off. ‘Once you run [a vulnerability assessment] and you see where the fault lines are, people will be much more aware if something is traveling in a particular direction,’ says Hopkins.

Both the business climate and the climate for activism will change, however, so companies must constantly monitor their registers, and revisit their strategy at least annually. ‘In this world, it’s very much the case that an ounce of prevention is worth a pound of cure,’ Hopkins concludes.

This article also appears in the shareholder engagement issue of Corporate Secretary, IR Magazine’s sister publication