When an activist investor demanded changes at ABN Amro, the world's largest financial services deal was set in motion

It is unlikely Rijkman Groenink, the former chief executive of ABN Amro who spent a total of 33 years at the bank, looks back on his final months with much nostalgia. In fact, reflecting on moments like his last annual general meeting (AGM) could well induce a cold sweat.

Groenink was forced to sit through several lengthy tirades from Peter de Vries, head of Dutch shareholder association VEB, criticizing his strategy. To add dramatic effect, Vries later stormed the stage and had to be restrained by security. Other shareholders present at the meeting then voted through a motion calling for ABN to be either broken up or sold, signaling the beginning of the end for the Dutch bank.

The sale of ABN – then the 11th-largest bank in Europe – demonstrates that big financial institutions are in the sights of, and vulnerable to, investor activism. ‘Pressure on banks has increased due to a combination of the sale of ABN and the subprime market crisis,’ says Louise Clamp, head of publications and public affairs at investor relations consultancy RD:IR. ‘I’m not sure ABN was a trigger for the pressure, but it is certainly symptomatic of it.’

Prime mover

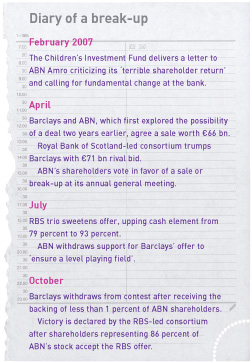

It was activist investor Christopher Hohn who made the initial call for change at ABN. His Children’s Investment Fund (CIF), which owned just 1 percent of ABN’s stock, sent a letter to Groenink and ABN chairman Arthur Martinez, stating: ‘We believe it would be in the best interests of all shareholders, other stakeholders and ABN Amro for the managing board to actively pursue the potential break-up, spin-off or merger of its various businesses (or as a whole).’

Investor relations teams at Europe’s big banks may have felt insulated from hostile crossborder raids as protectionist sentiment has reared its head in some recent deals in the industry. Most notably, UniCredit, Italy’s largest lender, had to compromise with the government of Poland over its desire to combine two Polish banks. In addition, French president Nicolas Sarkozy has spoken ambivalently about the free market – and has interfered in corporate deals involving French national champions.

But the ABN deal, the first unsolicited, cross-border takeover of a large European bank, sets a new precedent for the industry. When CIF targeted ABN, Nout Wellink, the head of the Dutch central bank, initially balked, claiming financial stability was at stake. Then a spokesperson for Charlie McGreevy, the EU’s internal market commissioner, weighed in, telling Wellink not to interfere. The Dutchman quickly changed tack and dropped his opposition. The die was cast and Europe witnessed a banking break-up of unprecedented size.

Many predict further activity in the banking sector. IR departments look likely to have their work cut out defending takeovers or getting shareholders to back proactive moves in the market.

‘Banks are going to be in the spotlight over the next 12 months,’ states Clamp. ‘I think you might see a bit more consolidation across Europe. Financial institutions must articulate their strategies and have a good understanding of the people who make up their shareholder base. The same is true for all companies, not just banks.’

Those who dare

While ABN suffered an investor relations nightmare, the banks that finally captured it fared much better. This is impressive given the fact that the subprime crisis hit as the bid battle was in full swing. The victorious consortium – comprising Royal Bank of Scotland (RBS), Spain’s Banco Santander and Belgo-Dutch operator Fortis – needed all their communication skills to beat out rival bidder Barclays and get shareholders to back the biggest financial services buyout in history.

Widely regarded as the weak link of the trio, Fortis pledged to raise around €24 bn ($35 bn) of the total €71 bn required. This included a €13 bn rights issue – a huge sum in relation to the bank’s size.

‘Roadshows were organized in late May and June after the bid announcement; we consulted with all top shareholders and investors ahead of the August extraordinary general meetings (EGMs) in Brussels and Utrecht, and again set up extensive roadshow programs before the September rights issue,’ explains Robert ter Weijden, director of investor relations at Fortis. ‘These EGMs marked a key milestone in the success of the bid.’

It wasn’t all plain sailing, however. A letter written by Groenink and later leaked to the press suggested Fortis had overestimated the profit it would make from the deal. Rumors also abounded that hedge funds planned to derail the rights issue, which offered two new shares for every three already owned at a heavily discounted price.

Despite all this, the hard work of Fortis’ IR department paid off. ‘Fortis shareholders agreed with the strategic and financial merits of the proposed transaction as evidenced by their support at the EGMs and the success of the rights issue in jittery markets,’ Weijden points out.

Less controversy surrounded the fundraising of RBS and Santander, which had to stump up €16 bn and €20 bn, respectively. RBS tapped its investors for some of the money and also offered €5 bn worth of its own stock to ABN shareholders. Santander combined bond issues and the sale of its Latin American fund management business with a sale-and-lease-back operation of its buildings and branches in Spain.

The bid battle for ABN Amro may be over, but the break-up of its constituent parts between the victors is likely to drag on for at least the next 18 months. The dual menace to IR of volatile markets and activist investors, two key aspects of the deal, will also linger for the foreseeable future.

Stormy outlook

Alfredo Sáenz, chief executive of Santander, is keenly aware of these dangers. At an investors’ day held during the tussle for ABN, Sáenz drew attention to the combination of ‘activist investors, hunting packs and increasing headwinds’ that he asserted is putting extra pressure on banks to demonstrate value.

Others involved in the ABN deal are also aware of the need to keep their game up. ‘Fortis is always striving to offer the best risk-adjusted return to its shareholders, and our investor relations department endeavors to give the best possible service to shareholders and prospects,’ notes Weijden.

The RBS-led consortium has highlighted both the possibilities and the threats residing in the European banking sector. Bankbased investor relations will need to be on its toes during 2008, as those who cannot hunt may well become the hunted.