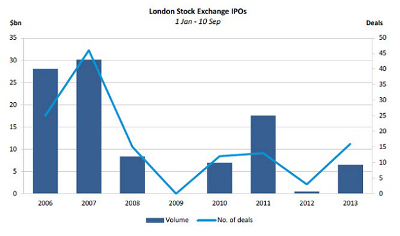

Value of public floats in UK reaches $6.5 bn in 2013; highest since 2007

IPOs registered on the London Stock Exchange (LSE) have hit their highest value since the economic crash – and more than eight times the amount raised in 2012 – according to Dealogic’s latest Equity Capital Markets statshot.

The study, which examines the number and value of IPOS between the beginning of the year and September 10, reports that 2013 is the strongest year for capital raising since the financial crisis. To date in 2013, 16 IPOs have been listed on the LSE, with companies raising $6.5 bn between them.

Source: Dealogic - ECM Statshot

This marks the highest level of activity in the period, in terms of equity raised, since 2007, when 46 IPOs were recorded, generating $32.5 bn. It also represents a five-fold increase on the value of the three deals priced in 2012 in the same period. The number of IPO listings for 2013 so far has also exceeded the full-year totals for 2011, which had 14, and 2012, in which eight were recorded.

Though the news has been greeted with a deal of optimism surrounding the health of the UK markets, opinion is divided on whether it can be seen as a sign of recovery. Part of that is rooted in an increase in US funds rebuilding their exposure to European companies through UK launches, as the dangers of the eurozone crisis subside.

‘Typically, US investors now account for 30 percent-40 percent of investors in UK IPOs and they also have plenty of cash,’ says Adam Young, head of global equity markets advisory at Rothschild. ‘The value the stock market can deliver to sellers is competitive with mergers and acquisitions. The current season is good.’

David Ewing, managing partner of private equity specialists ECI, warns that uncertainty still remains in the markets, however. ‘While a recovery is well and truly under way, it is still in its early phases,’ he says.

Featuring five listings so far, the real estate sector is the most active for London-listed IPOs and at its busiest since the same period in 2007, when seven IPOs were priced. This is without the recently announced IPO for London-based property agency Foxtons, which is expected to raise $558 mn through Credit Suisse and Numis Securities. The finance and utility & energy sectors have also enjoyed a relatively strong showing, with each recording three new offerings.

In addition, the report finds that the average one-day return for LSE-listed IPOs stands at 5.7 percent so far this year, the highest average seen in this period since 2006, when it stood at 6.6 percent. JPMorgan is reported to have been bookrunner to the most IPOs thus far, with $874 mn of deals to its name, followed by Goldman Sachs and Barclays, with $872 mn and $833 mn, respectively.