Stock Clout designed specifically for investors and public companies

A new social network built to connect investors and listed firms is bringing in 700,000 visitors a month, says founder and CEO Tony Golden.

Gathering information from a variety of sources – corporate press releases, analyst opinion updates and filings, blogs and social media articles – the free service delivers twice-daily reports of the stocks you own or follow, which Golden says frees up more time for the average investor or IRO.

The service, launched in August 2012, also aims to connect public companies to the information that matters to them: Stock Clout offers full-site analytics so any registered public company can see exactly which investors are following it.

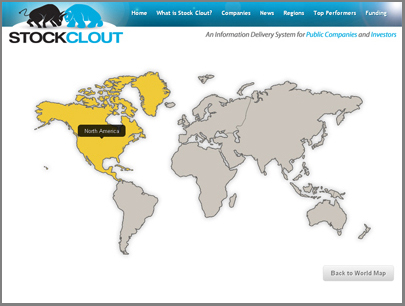

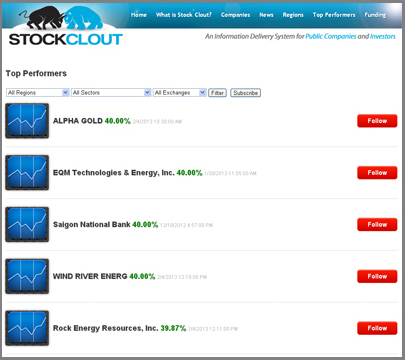

Golden believes many investors lean toward a particular region when making stock decisions so, as well as offering full company listings, the network also offers a list of ‘top performers’, which can be filtered by region, sector or exchange. Stock Clout’s interactive world map takes the regional search even further, allowing investors to find stock information by region, then by country and even by state in the US.

The Stock Clout map lets you filter firms by region, country and US state

‘We decided to do this because we believe most investors have a geographic bias,’ explains Golden. ‘And the public companies themselves appreciate having local, home-grown investors as their shareholders.’

After more than 30 years on Wall Street – 15 of them spent at companies including Lehman Brothers and Bear Stearns – Golden moved on to set up his own IR firm, Shareholder Development Group, in Atlanta, where he spent 17 years before stepping back from investor relations to set up Stock Clout.

Choose the companies you want to follow for daily stock ‘Clouts’