Social media helped TVI Pacific boost its visibility, save time and correct misinformation in the market – all for little financial outlay

When Rhonda Bennetto joined TVI Pacific in August 2009, the story hadn’t been getting out at all. The company has mining operations in the Philippines but a Canadian listing and investor base and, as Bennetto discovered, there was little information flowing between the two. What’s more, misinformation was out in the market and being recycled by bloggers on chat forums.

Fast forward two and a half years and the picture has changed substantially, largely thanks to a low-cost IR program that lent heavily on social media. TVI Pacific is a ‘very small cap’ so the low-cost approach was ‘a natural fit,’ says Bennetto. ‘Social media can be done relatively cheaply.’

The program’s only major investment was a new website. Bennetto, who left TVI in April to run corporate communications at fellow mining firm Great Panther Silver, says she pulled a few strings with industry contacts and managed to get this done relatively cheaply.

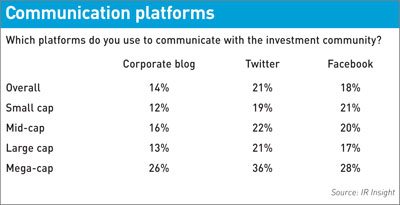

While social media offer a low-cost option for smaller companies to get exposure, it is bigger companies that are more likely to use platforms like blogs and Twitter to communicate with investors, according to a global survey of investor relations practices by IR Insight, the research arm of IR magazine (see below).

For example, only 19 percent of small caps polled say they use Twitter for investor communications, compared with 21 percent overall and 38 percent of mega-caps.

This is probably explained by the bigger teams at large-cap issuers, which are better placed to handle the time commitment social media tend to require. Still, Bennetto managed the process on her own and says the time commitment diminished after a busy initial few months.

‘I knew that once I got the facts out there, things would start to take care of themselves, so it would take up less of my time,’ she explains. ‘The first few months were busy but then things came about very quickly.’

Bennetto began by setting up a Facebook page, YouTube portal and Twitter feed. Twitter was used simply as a directional tool to drive people to the website, she says. Meanwhile, Flickr, the photo-sharing network, and SlideShare, which allows users to upload and share presentations, were both embedded in TVI’s new site.  Bennetto says she used as many visual social media channels – like Flickr and SlideShare – as possible to help bridge the gap between investors in Canada and operations in Asia. ‘As it’s so far away, you have to be able to see what is going on,’ she explains. ‘A picture is worth 1,000 words.’

Bennetto says she used as many visual social media channels – like Flickr and SlideShare – as possible to help bridge the gap between investors in Canada and operations in Asia. ‘As it’s so far away, you have to be able to see what is going on,’ she explains. ‘A picture is worth 1,000 words.’

To deal with misinformation on chat sites, Bennetto approached and built relationships with bloggers in the way IROs more commonly approach sell-side analysts and third-party experts to help tell the company story.

‘I ended up making friends with a couple of bloggers who would kindly post for me saying, Well, that’s not true, and linking through to our site,’ she states. Like analysts, some of the bloggers would even send their posts to Bennetto to check the facts before they were published.

TVI Pacific’s Facebook page was used to create an official discussion forum for followers of the stock. The company encouraged shareholders to write questions and then posted the answers on the social network. As IR magazine went to press, the page had attracted an impressive 403 ‘Likes’ on Facebook.

What were the results?

The miner’s approach to IR quickly began to pay reputational dividends. One of the main results was a surge in internet traffic to the new site, a sign investors were beginning to use the company as a key information source. ‘The hits on our website went up by almost 400 percent right away as people started to go there to get their information instead of relying on incorrect chat rooms,’ says Bennetto.

After the first year, the number of hits on the website went from a couple of hundred to about 20,000, she adds: ‘They were coming from Twitter, Facebook and all these different channels. There’s people who still don’t like the stock but at least they have their facts straight.’

Phone calls about incorrect information began to tail off, too. In the beginning, Bennetto would receive around 50 calls a week from investors asking: ‘Is this true?’ After a year, this had dropped to only one – or even none – a week. The number of bloggers bashing the stock also fell to nearly zero. ‘We were down to one – and he’ll never be happy, right?’ she concludes.