Quick steps for IROs whose constituents include the financial media

Dealing with the media – financial or otherwise – is a responsibility that is increasingly being integrated into IR. At least, that’s the picture being painted by recent research, which suggests many IROs are having to add the financial media to their constituencies.

According to Outsourcing IR, a report published by IR Magazine in October 2014, 46 percent of respondents have primary responsibility for their company’s financial media relations, while 37 percent say it is among their secondary responsibilities. Similarly, 69 percent report that financial news releases fall within their primary remit as an IRO.

Financial media relations is also one of the least common aspects of an IRO’s job outsourced to external service providers, the research finds, with only 8 percent of respondents reporting that it is handled by another firm at an average annual cost of $44,000.

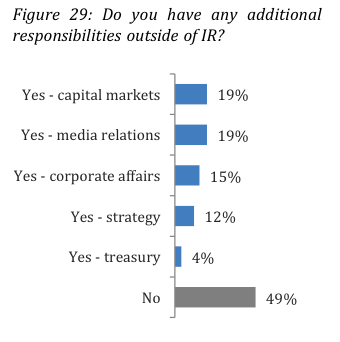

Marina Zakharova de Calero, director at Citigate Dewe Rogerson, also sees the role of the IRO generally taking on more responsibility for media relations. Citigate Dewe Rogerson recently surveyed 193 IROs as part of its annual IR survey – entitled ‘Shaping the future of IR: a new era of opportunity and challenges’ – and investigated how respondents had integrated other disciplines into their current role.

‘Based on the findings of our annual IR survey, it is evident the majority of IROs are increasingly involved in complimentary functions within their organization,’ Zakharova explains. ‘Nearly a fifth are taking over responsibilities for financial media relations.’

Source:Citigate Dewe Rogerson, 7th annual investor relations survey

Here, Zakharova offers her top five tips for IROs who are wondering how to integrate media relations into their current role.

1. Get to know your new audience

What are their priorities, focus, areas of responsibility, editorial position? Who are the movers and shakers? What are their views of the company and industry and their specific angles, issues or areas of interest? What are their filing dates and times – journalists are far more subject to time-sensitivity. In practical terms, you should also have their updated contact details to hand.

2. Make sure your message is consistent

Ensure consistency of corporate messages for the media and the investment community so that there is a clearly defined and differentiated equity story, as well as a set of supporting data and key performance indicators.

3. Shape the message according to your audience

Tailor the delivery of your disclosures and follow the needs of your audience. For example, after the publication of a big announcement, newswires might be interested in a short Q&A session with the management for comment and color, while analysts would be looking for an hour-long conference call or presentation and an opportunity to quiz management in more detail.

4. Remain vigilant for leaks

Review your internal systems and policies to prevent any potential unintentional leaks of sensitive information. Ensure employees know what to do when contacted by the media.

5. Keep management informed

Brief your management team ahead of any contact with the media, clarify the objectives and purpose of the planned engagement, and have media Q&As ready and rehearsed ahead of important announcements.