Janet Dignan talks to Michael Woodford, the CEO whistleblower who’s become a hero of corporate governance

One thinks of whistleblowers as relatively low-level mortals in a corporation; after all, directors participate in – or certainly should participate in – all key decision making, and they’re hardly likely to blow the whistle on themselves.

The case of Michael Woodford at Olympus, however, is an exception. By 2011, when he became president of Olympus, he was a 30-plus year veteran of the company who had joined as a salesman in his teens and was now head of the group’s European business.

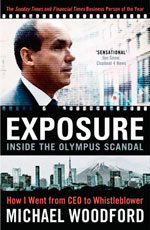

Yet his acceptance of the offer from Tsuyoshi Kikukawa wasn’t quite instantaneous, not least because Woodford’s wife Nuncy was far from enthusiastic.  Still, for Woodford the prospect of a four-year stint in Tokyo at the top of the company he loved was nigh-on irresistible. He describes it in his book, Exposure, as ‘the top job in the organization for which I had worked long and hard. I was a foreigner, yet I had been chosen to lead this huge Japanese corporation and its 40,000 employees.’

Still, for Woodford the prospect of a four-year stint in Tokyo at the top of the company he loved was nigh-on irresistible. He describes it in his book, Exposure, as ‘the top job in the organization for which I had worked long and hard. I was a foreigner, yet I had been chosen to lead this huge Japanese corporation and its 40,000 employees.’

That was the upside. On the downside, he was moving to Tokyo just two weeks after the largest earthquake in Japan’s history. Moreover, he was moving to the head office at a time when Olympus was in trouble. ‘Even before the earthquake, its balance sheet was worryingly over-leveraged and costs were out of control,’ Woodford records. ‘It was one of the most indebted businesses in Japan.’

At least these were known factors. It was the things Woodford didn’t know that caused him most consternation. His book is fascinating not just because it’s a rollicking good story about fraud, corporate governance and the Japanese mafia, told by an interesting and decent man, but also for the insights it offers into Japanese culture.

Executive orders

Before Woodford’s appointment, Kikukawa had been both president and chairman; following his appointment, his predecessor took the new title of CEO. And as Woodford says, ‘it quickly became clear that the new CEO title trumped the presidency.’ So, for instance, Kikukawa had ultimate power to hire and fire directors and set their compensation.

That was annoying for Woodford, but it proved far more than that when the fraudulent activities undertaken during Kikukawa’s leadership started to be revealed.

For Woodford that happened on a train journey a few months after taking up his new position, during which an old Japanese friend translated an article for him from Facta, an atypically scurrilous Japanese magazine that had decided, in its own words, to ‘expose the shenanigans by Kikukawa and Co that threaten to decimate Olympus’ net worth.’

Woodford listened to Facta’s accusations, which he describes as ‘wild and yet… meticulously detailed’. Facta charged Olympus with overpaying for UK medical equipment company Gyrus Group, which it bought in 2008 for around $2 bn, about 40 percent more than its market cap.

Woodford had known about this at the time. As he says now, the price was toppy, but there wasn’t necessarily anything wrong in that. What he had not known was that in 2010 a further $700 mn worth of payments had been made.

And there was more. Facta alleged that Olympus had bought three other companies, all with small revenues and no strategic relevance: a mail-order face cream company, a company making microwave dishes, and a recycling company.

Justification for the acquisitions aside, it seems inexplicable the person running Olympus in Europe would not have known about them at the time. ‘No one knew,’ says Woodford. ‘It wasn’t announced and I wasn’t on the board of the Tokyo company, so I had no inkling it had spent nearly $1 bn on these three Mickey Mouse firms.’

Were shareholders also unaware of what was going on? Were they concerned? ‘Southeastern Asset Management – the largest outside shareholder at the time – questioned the $700 mn but was told it was for costs relating to the acquisition,’ says Woodford.

At three times the costs associated with any previous acquisition (the next biggest was for the sale of ABN Amro to RBS), this was patently implausible. ‘So more sophisticated shareholders continued to ask questions, but they got inaccurate answers.’

The cold shoulder

Nevertheless, Facta’s revelations sparked little or no interest in Japan at the time. Woodford was amazed to find nothing in the mainstream press, and even in the Olympus office there was no mention of it until he asked two trusted colleagues whether they had seen the Facta story. Both admitted they had but said they’d been instructed by Kikukawa not to tell Woodford.

So next day Woodford had his secretary fix a lunch meeting with Kikukawa and right-hand man Hisashi Mori. The two Japanese men were presented with a magnificent platter of sushi, which Woodford adored (‘as the two men knew full well’), while Woodford was given ‘a sad-looking tuna sandwich of the sort you’d expect to find at a suburban train station kiosk.’

The rest of the meeting was equally unsatisfactory. The rest of the book is not. It manages to mingle the intensely personal side of Woodford’s story with the public, corporate one. We may have all read the story in the press over the past year or two but now we follow every detail, and understand it at an entirely different level.

We can make sense of it in the Japanese corporate and cultural context, and learn so much about the mores of that country. We come to understand where the urbane and persistent Woodford found his determination, and we come to respect that drive.

This may sound like too much praise, but listen to what investigative journalist Jake Adelstein has to say: ‘What makes Michael Woodford a hero is that instead of going quietly, he told the world what had happened.’

Or Koji Miyata, former Olympus senior executive: ‘Several knew what was going on, and all but one kept their silence, pretending to have seen nothing, waiting for the storm to pass. Michael alone took a principled and uncompromising stand.’ Better still, read the book.

Exposure: inside the Olympus scandal – how I went from CEO to whistleblower, by Michael Woodford, is published by Portfolio Penguin.