Pyshkin manages $1.5 bn in active global equities from Aviva's London office

Aviva Investors is the global asset management business of Aviva, one of the world’s largest insurers, operating in 15 countries in Asia-Pacific, mainland Europe, North America and the UK with assets under management of more than $400 bn.

Kirill Pyshkin is responsible for managing global equity funds. He joined Aviva Investors in 2008, prior to which he spent four years as an equity research analyst working for Sanford Bernstein and JPMorgan on the sell side, and Credit Agricole Asset Management (now Amundi) on the buy side. Kirill started his career as a management consultant in 2000. He holds a PhD in physics from the University of Cambridge, and a master’s in business administration from Imperial College, London. He is a native Russian speaker and a graduate of Saint Petersburg State Technical University.

Kirill started his career as a management consultant in 2000. He holds a PhD in physics from the University of Cambridge, and a master’s in business administration from Imperial College, London. He is a native Russian speaker and a graduate of Saint Petersburg State Technical University.

How much does the London office manage in equities?

We manage $50 bn in total, including active quant and index equities of $33 bn. I manage $1.5 bn in active global equities.

Aviva owns Kentucky-based River Road Asset Management with assets under management of $7 bn. Do you confer with it?

I know what it holds and vice versa, but my style is very specific. River Road tends to focus on small and mid-cap US equities; I focus on large caps ($30 bn+) and mega-caps ($70 bn+).

Which screens do you use?

I use our own custom screens looking for dividend growth, sustainability of the dividend and attractive valuations. I also use Credit Suisse’s HOLT screen and the cash return on capital investment measurement, but screens are just tools and they never drive my investment process.

Do you meet companies as part of your investment process?

I always meet companies; I would never invest in a firm where I hadn’t met with management. I prefer one-on-ones with senior management teams but will do a conference call if necessary.

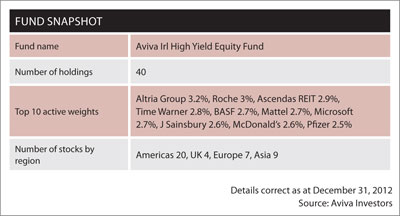

Can you describe the global income fund you manage?

It’s a concentrated portfolio of 40 names, with 50 percent of them in the Americas. Typically these are blue chip, high return-on-equity companies with high and rising dividends. The portfolio itself is very well diversified across sectors and geographies, and provides a dividend yield of 25 percent to 50 percent above the MSCI World Index, with the goal of beating this benchmark with less volatility and lower risk.

What is the minimum yield threshold for your global income fund?

I look for a minimum yield 25 percent above the MSCI World Index, so 1.25 times the MSCI.

In your global income fund, what’s an average position?

The fund has 40 positions in a concentrated portfolio, so 2.5 percent is an average position weight. The size of the position depends upon the level of conviction and some technical criteria such as liquidity, benchmark weighting, and so on.

A large-cap company would typically have a larger weighting than a smaller cap. I also monitor volatility as we aim to have less volatility and risk than the index. I actively manage volatility by limiting positions in more volatile stocks.

The largest position could be 5 percent but I tend to stop at 4 percent. In theory, 1 percent would be the smallest position but in reality it is 1.5 percent.

What are your largest positions, and why did you buy?

If you look at my largest positions today, they are mostly blue chip holdings. My biggest active position is Altria, the Marlboro maker in the US, followed by Roche, Ascendas REIT, Time Warner, BASF, Mattel, Microsoft, J Sainsbury, McDonalds and Pfizer.

Altria is a core holding – 3.2 percent active position, 3.5 percent of the fund – and some of the positions like Altria I keep as anchor holdings for the fund due to their stability of earnings and dividends. Then I’ll take some positions where I can see much more upside but they would typically be smaller holdings.

Altria is a leader in its market: Marlboro has by far the largest share of the tobacco market in the US and what I like about it is that it is insulated from most of the regulatory and legal challenges that face Philip Morris International (PMI) in other markets.

For example, PMI is being hit by proposals of the new EU directives on tobacco regulation but the US has already been through that process. So I believe Altria’s future is more secure than Philip Morris’ even though it’s the same brand of cigarettes.

I used to have other tobacco holdings but I have consolidated everything into Altria now because, for me, the US has passed the most risky time for tobacco stocks.

Microsoft is another core holding: 2.7 percent active position, 3.5 percent of the fund. It has recently been out of favor due to weak consumer PC sales, but it has a strong business division and is offering enterprises server tools – it is not just about consumer PCs. It is a very good dividend yielder in the US, which makes it a rarity among US technology companies.

The US market itself has one of the lowest dividend yields in the world and the technology sector is one of the lowest yielders within the US. I try to find companies that are stable, with high and growing dividends, and which are attractively valued.

Microsoft is attractively valued, with a secure and growing dividend and, in my view, fears around [the impact it may feel from] PC market weakness are overblown. This issue is less significant for Microsoft than it is for Dell or HP.

Are there any particular sectors you don’t like?

Utilities and telecoms. For me, the most important criterion is dividend growth as opposed to absolute yield so I try to focus on companies that pay high but growing dividends, and with utilities I see very little opportunity for growth.

In my view dividends are not sustainable and payout ratios are stretched in that sector. The only good thing about utilities is that their yield compares favorably with US treasuries but that’s about it in terms of attraction.

Telecoms also present a very depressing industry picture considering already high penetration of wireless services. There is some hope for growth reinvigorated by wireless data but the number of fixed lines is falling and that was the more profitable business. I don’t see many growth opportunities in telecoms.

What about recent sales – any particular reasons for selling?

I recently sold Intel as it is directly affected by the weakness in the PC market. Ever since Apple introduced the iPad, sales of PCs have been very poor – in Q3 2012, there was also a decline in notebook sales.

In the past there was desktop decline and notebook growth but in that quarter they both declined because more and more people are buying iPads. I feel the situation for Intel will get worse because, even if it is successful in entering the tablet market, the average selling price for computer central processing units will go down.

Now that ARM Holdings has been successful in providing an alternative processor, Intel is under pressure from both loss of market share and weak average selling prices.

As a result, its wafer fabrication plants are underused, which hits the gross margin. At the same time, there is an arms race between Intel and Samsung to see which of them is going to outspend the other in terms of capex. It’s not an ideal combination.

PG&E is another recent sale. This is a Californian utility that had a fatal explosion: its gas pipe blew up and people were killed in San Bruno. Typically, when that happens the company could be in the penalty box for many years.

Given the capricious nature of politics in California, the accident will affect the state regulator’s future decisions – so in addition to as yet unclear penalties, future dividends may be constrained.

I certainly don’t expect any growth in the dividend from PG&E and generally very little positive news flow. As a result, I now don’t have any utilities in the main funds – that was my only one.

What constitutes your average holding period?

Three years is the average length of a holding. I run a high-conviction, low-turnover fund, which is why I like to meet management team members. I try to find out as much as possible about the companies I buy to limit any nasty surprises and have a good understanding of their long-term strategy.

What’s your market cap cut-off?

I generally won’t buy companies with market caps below $2 bn.

Do you have a price target when you buy a stock?

I typically look for a minimum 15 percent upside. I have a price target for all my holdings and monitor them daily. When a stock is approaching that target, I re-evaluate it. If I don’t see further upside, I sell.

The principle for the fund is one stock in, one stock out, and the sale decision is driven by valuation or by the dividend being at risk.

As an income investor, in each region I try to get a yield higher than the market. The US market’s yield is 2.2 percent and my yield is 3.2 percent. In the UK, it is 3.6 percent and my yield is 4.6 percent.

It would be easy to construct a higher-yielding fund by focusing more on the UK and Europe but we would prefer to offer diversification by geography and sector, and focus on stock picking instead. We are looking for the best companies in each sector.

How many companies do you meet a year?

I met 125 companies in 2011 and a similar number in 2012. I meet two thirds in the US, Europe and Asia and the rest in London. I make two or three long trips a year, splitting my time between the US and Asia. I normally meet between two and 30 companies per trip, either at conferences or company offices.

Which US firms are best at IR?

US and Canadian companies are pretty good at IR, especially when compared with some Japanese and Chinese companies. They’re very professional and well prepared. Intel, Time Warner, JPMorgan, TD Bank and Blackstone are all particularly impressive, to name just a few.

From meeting management I aim to get to know the company and its industry better – perhaps it is exposed to a beneficial theme or a trend or there is a company-specific reason to own the stock. For example, the company may be withdrawing from a lower-margin business and therefore margins overall should rise.

What are your market predictions for 2013?

I think the market will go nowhere until March when the debt ceiling issue is resolved. I expect between 5 percent and 15 percent upside for the US equity market, more for emerging markets and European equities because of relative valuations. Overall, 2013 should be a good year for equities.

I base this on an overvalued fixed income market – there have already been some flows into active equities and high-yield equities as an alternative to low bond yields.

Global equity income funds are excellent as a combination of income with capital appreciation, and for the last three years there have been double-digit returns.

Gill Newton is a partner at Phoenix-IR, the independent investor relations consulting firm (www.phoenix-ir.com).