A preview of IR magazine’s global survey on resources, department structure and budget management

Budgets everywhere have been put under strain. IROs worldwide report increasing scrutiny of return on investment as a lasting legacy of the financial crisis. IR vendors, meanwhile, complain of increased competitiveness in the market for IR services, as issuers drive increasingly harder bargains with their suppliers to achieve better-value services.

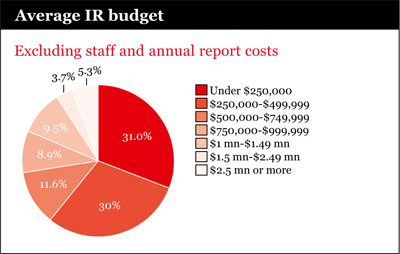

The survey reveals a wide range of IR budgets around the world with large variations in the proportion of budgets allocated to external IR support. But there is little correlation between the size of the IR team and the proportion of the budget allocated to external support.

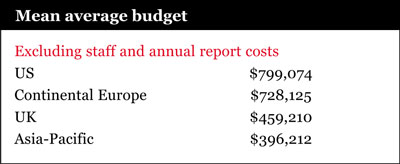

Budget size

For the survey, a total of 205 respondents from leading IR practitioners around the world were polled in June and July 2010. Issuers in Asia-Pacific are the most budget-constrained on the whole, while those in Brazil, the US and continental Europe enjoy above-average IR budgets. Eight of the 11 companies with the largest budgets – more than $2.5 mn per year – are located in continental Europe.

Companies in continental Europe and the US have the highest proportion of budget allocated to investor relations (calculated without staff or annual report costs). The modal budget size for US corporates surveyed is in the $1 mn to $1.49 mn bracket. For continental Europeans and UK issuers, the modal budgetary band is $250,000 to $499,000.

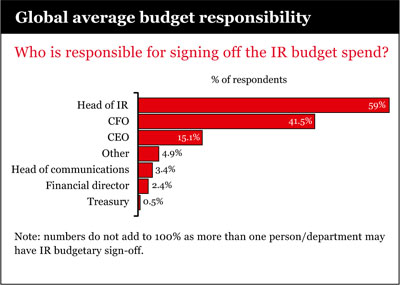

Budget sign-off

IROs don’t always have the ultimate say on their budgets. Many have to share sign-off responsibilities with a member of senior management; nearly half of those polled have to run their decisions past the CFO or CEO. Issuers in continental Europe are the most autonomous, with 64 percent signing off their own budgets. Corporates in Asia-Pacific are the least autonomous in terms of budgets, with only 48.6 percent having sign-off.

External IR support

The figures show the majority of IR departments polled manage their IR activities in-house; outsourcing to vendors represents a relatively small proportion of overall costs. Interestingly, there is little variation between regions, with the exception of Brazil, which is an outlier. The average Brazilian respondent devotes nearly 30 percent of its budget to external IR support, compared with a global average of 20 percent. The Canadians, continental Europeans and Asia-Pacific respondents outsource the least.

Department size

What is the optimum size for an IR team? The answer obviously depends on the scope of the program and the size of the outsourcing budget. Issuers in developed markets, such as North America or the UK, tend to have slightly smaller-than-average IR teams. The exception to this is continental Europe, where the average team size is 4.2 people.

One possible reason for the UK’s smaller IR teams is its strong tradition of corporate broking: UK firms traditionally saved money on investor relations because they could rely on brokers to do some of their work for them. The financial crisis has put a dent in the UK corporate broking tradition, however, and UK companies are now serviced less by brokers.

About XbInsight

XbInsight is IR magazine’s research brand, building on the publication’s established research efforts. Since 1991, IR magazine has taken its renowned investor perception study around the world to markets as diverse as Brazil, China, Singapore, the Nordic region, South Africa, Canada, the UK and the US. Across the global markets, thousands of buy-side analysts, sell-side analysts and portfolio managers are asked which companies have the best IR.

XbInsight is now building on that expertise and launching a series of studies examining successful IR and the key drivers of investor sentiment. It also provides:

- High-quality thought-leadership studies

- Benchmarking initiatives, including IR magazine’s online interactive benchmarking tool

- Global consolidated IR magazine research.

Specifically, the research division at XbInsight is looking to understand why some firms perform better than others in IR magazine’s investor perception studies. The first step in conducting this analysis is to gain a deeper understanding of the different IR practices at listed companies around the world.