Latest IR Magazine research gathers opinion on the best use for excess corporate cash

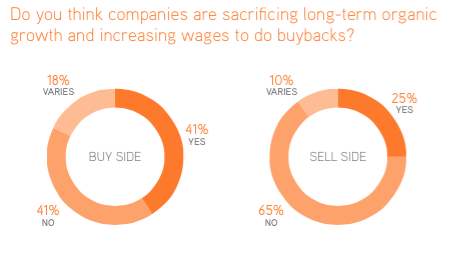

More buy-siders than sell-siders believe companies are sacrificing too much to fund expensive share buybacks, according to IR Magazine research into what the investment community thinks about the best way to spend excess cash.

As part of the research for the Investor Perception Study – US 2016, buy-side and sell-side respondents were asked some general questions of interest to the IR community, including: do you think companies are sacrificing long-term organic growth and increasing wages to do buybacks?

Forty-one percent of US buy-siders agree with the statement, compared with just 25 percent of those on the sell side. Correspondingly, the sell side is far more likely to disagree with the sentiment (65 percent) than respondents on the buy side (41 percent).

Source: IR Magazine Investor Perception Study – US 2016

The reasons for this split in opinion are not entirely clear, though looking at the additional comments provided by those surveyed does add some extra color. One sell-sider, for example, summarizes the situation fairly briefly: ‘Buybacks are acceptable only for companies that have a lot of excess cash, which is not always the case at companies doing them.’

Those who respond negatively often pick out the non-sustainable nature of excessive buybacks. ‘There is a big gap between corporate margins and income growth, which is at an all-time high,’ says one buy-sider, adding that the practice cannot continue, while a sell-sider points out: ‘It is not a good thing in the long term.’

Those who disagree with the question fall into two camps: those who believe buybacks are a good use of excess cash and those who don’t see them in their sector or the companies they cover.

‘This is political bashing: buybacks are being given a bad name,’ notes a buy-side respondent. ‘The anti-buyback message is a red herring. Within a mix of choices for allocation, buybacks provide good shareholder value.’

A third group of respondents – those equivocal about the issue – generally point out that it depends on the individual industry, sector or company as to whether buybacks are appropriate.

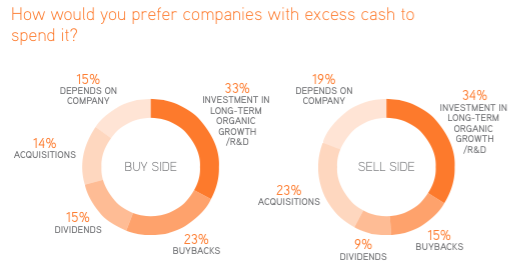

So if companies should not be spending cash on buybacks, what would be a better use of the money?

Source: IR Magazine Investor Perception Study - US 2016

Answers from the buy side and sell side largely align on this: around a third of each camp picks out investment in long-term organic growth as the best use of excess cash, with buybacks, acquisitions and dividends following closely behind.

This question produced only minor differences between buy-side and sell-side responses, however, with many noting that it’s often a company-specific question and others suggesting that a combination of options may be best.

The answer to the question of how to spend excess cash, therefore, remains dependent on a number of factors. For the majority of our respondents, a careful mix of returning shareholder value and investing in a company’s future seems the best approach.