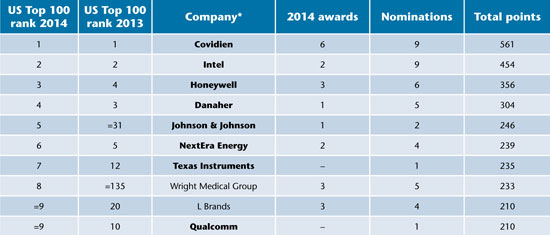

Covidien retains large-cap prizes while other firms surge up the rankings at the IR Magazine Awards – US 2014

Covidien defended its position at the head of the pack at the IR Magazine Awards – US 2014, holding on to both the grand prix for best overall IR at a large cap and the best large-cap IRO award for the fourth year running.

The medical device company picked up six awards out of a possible nine for which it was short-listed, firmly cementing its place at the top of the US Top 100 rankings.

Hot on Covidien’s heels and also holding onto its second-place ranking came Intel, with the tech firm’s IR team taking home two awards. Fellow large-cap outfit Honeywell claimed three awards from the six short lists on which it appeared, with the conglomerate’s David Anderson retaining his title for best IR by a CFO at a large-cap company.

Meanwhile, retail group L Brands pushed into the top 10 US companies after picking up three trophies on the evening, including the prestigious grand prix for best overall IR program at a mid-cap company.

This year’s awards ceremony – held on March 27 at Cipriani Wall Street in New York City – also saw a number of new firms arrive on stage to receive an IR Magazine Award, including Wright Medical Group, which climbed more than 100 places in the US rankings and saw its head of IR, Julie Tracy, pick up the gong for best IRO at a small-cap company.

Other firms outdid even Wright Medical’s improvement on 2013: utilities company Edison International surged 226 places up the rankings to finish inside the top 20, while media group Time Warner’s 15th-place spot marked a 120-position upgrade.

The winners of the IR Magazine Awards – US 2014 were determined through an independent survey of 700 US investment professionals, the full results of which are available in the IR Magazine Investor Perception Study – US 2014.

The study also features in-depth interviews with IROs and senior management from award-winning companies, the complete company rankings and comments from investors and analysts that detail why these companies have impressed. To order your copy of this valuable resource, please visit www.irmagazine.com/research.

Covidien

US Top 100 rank: 1

Awards

Grand prix for best overall investor relations program – large cap

Best investor relations officer – large cap

Best IR by a CEO or chairman – large cap

Best investment community meetings

Best investor relations during a corporate transaction

Best in sector – healthcare

What the investment community says: ‘Hands down the best investor relations contact is Cole Lannum, who is super-responsive and knowledgeable. Covidien’s IR program remains the model for others to follow’ – sell side

What the company says: ‘We think of all our constituents, the entire investment community, agnostically. Whether I’ve got someone I’ve never heard from before who runs $10 mn of assets or Fidelity or Capital Research or the Government of Singapore or a retail investor before me, we try to treat them all in exactly the same way’ – Cole Lannum, head of investor relations

Intel

US Top 100 rank: 2

Awards

Best use of technology for investor relations

Best in sector – technology

What the investment community says: ‘We are only a small organization, but if we’re coming through town Intel will do a presentation or take us for dinner. It really knows its stuff and the CEO is particularly hands-on. Intel is a company on top of its game’ – sell side

What the company says: ‘We try to be both proactive and responsive, so investors know they can get to information and answers quickly. That includes making the IR team and the leadership team accessible, not just at company events, but also at the industry events that investors attend’ – Mark Henninger, director of IR

Honeywell

US Top 100 rank: 3

Awards

Best IR by a CFO – large cap

Best financial reporting

Best in sector – diversified industrials

What the investment community says: ‘Honeywell is always happy to discuss things with us, even when things haven’t worked so well’ – sell side

What the company says: ‘It helps that we don’t try to reinvent ourselves every year. Instead, we’re relentless about evolving and improving, doing what we say we’re going to do, and then consistently and concisely reporting our progress and results’ – Elena Doom, head of IR

Danaher

US Top 100 rank: 4

Awards

Best corporate governance

What the investment community says: ‘Danaher was a laggard on responsiveness because it had only one, albeit very capable, IR professional. This is changing with the recent additions and I anticipate much better capability as they get up to speed. The company meetings, on the other hand, have always been outstanding’– sell side

NextEra Energy

US Top 100 rank: 6

Awards

Best sustainability practice

Best in sector – utilities

What the investment community says: ‘The IR team at NextEra knows how to make my life simpler. There’s a great website and the firm does a good job of getting stuff to us, like tables of all the information available, for example’ – sell side

What the company says: ‘We’re one of the cleanest energy generators in the country. Our strategy is focused on clean renewables in our wholesale business, so our IR is certainly centered on it’ – Julie Holmes, former head of IR

Wright Medical Group

US Top 100 rank: 8

Awards

Grand prix for best overall investor relations program – small cap

Best investor relations officer – small cap

Best IR by a CEO or chairman – small cap

What the investment community says: ‘Julie Tracy, IRO at Wright Medical, sends out everything I need and then a questionnaire to check how she could do her job better. She is extremely proactive and very good at her job as a result’ – sell side

What the company says: ‘I think if an IRO can convey enthusiasm and passion to his or her investor base, it will serve him/her well. It’s a fun opportunity and I can’t think of another job I’d rather be doing’ – Julie Tracy, head of investor relations

L Brands

US Top 100 rank: =9

Awards

Grand prix for best overall investor relations program – mid-cap

Best IR by a CFO – mid-cap

Best in sector – retail

What the investment community says: ‘L Brands has the highest-caliber brands, is run by the highest-quality management and the IR team is the best in the sector. It’s the gold standard’ – sell side

What the company says: ‘All of our businesses are focused on retail fundamentals: disciplined management of inventory, expenses and capital; speed and agility; store selling and execution; and square footage growth’ – Amie Preston, head of IR

Starbucks

US Top 100 rank: =13

Awards

Best use of social media

Best in sector – leisure, media & restaurants

What the investment community says: ‘Troy Alstead steadily invested in new top-line growth areas while dramatically improving the return on investment. JoAnn DeGrande is one of the most responsive and attentive IR people in the consumer sector’ – sell side

What the company says: ‘We feel a strong responsibility to talk to our investors in the forums they use most. To date, they’ve indicated they do not actively use social media for IR-related engagement, but they do recognize the value it contributes to our company from a marketing, brand recognition and customer engagement perspective’ – JoAnn DeGrande, vice president of IR

Actavis

US Top 100 rank: =39

Awards

Best IR by a CEO or chairman – mid-cap (joint winner)

What the investment community says: ‘Actavis gets the balance on guidance just right by providing insight on both the short term and the long term’ – buy side

What the company says: ‘It’s important to change things, and not to be afraid to say ‘no’ if it doesn’t make sense for the company or for management. I try to ensure I’m always making the best use of management’s time: that way, when I ask for its time to meet with investors, it always says yes’ – Lisa DeFrancesco, vice president of IR

CIT Group

US Top 100 rank: 60

Awards

Best investor relations officer – mid-cap

What the investment community says: ‘You get proactive and knowledgeable IR from CIT’ – buy side

What the company says: ‘It’s about having a strong team – so any member can answer a call from an investor and can provide the same high level of information – and about the collaboration between that team and management to make sure priorities are aligned. It’s that ongoing partnership that matters to our shareholders and potential investors, and how we as a company make decisions that support the investment community’ – Ken Brause, former head of IR

PVH Corporation

US Top 100 rank: 68

Awards

Best IR by a CEO or chairman – mid-cap (joint winner)

What the investment community says: ‘The CEO of PVH, Emanuel Chirico, is able to manage his own guidance and communicate it to the Street. He is accessible at every conference and presents on all conference calls’ – sell side

Werner Enterprises

US rank: =144

Awards

Best IR by a CFO – small cap

What the investment community says: ‘The CFO at Werner is easy to get on with and can answer our questions with ease’ – sell side

What the company says: ‘I take very seriously the responsibility to effectively and accurately tell our story. Throughout our company, our leadership team strives to deliver a consistent message to all of our stakeholders, be they investors, customers, vendors or our associates in the media’ – John Steele, CFO

Allscripts Healthcare Solutions

US rank: =168

Awards

Best crisis management

What the investment community says: ‘Seth Frank, the head of IR, is knowledgeable and professional, and he understands the needs and difficulties of the Street. He was particularly impressive when the CEO tried to sell the company to a private equity firm: he managed to answer our queries as fully as he was allowed, and handled a difficult situation with poise’ – sell side

What the company says: ‘I think there are certain industries that in IR require domain expertise to be successful; healthcare is absolutely one of them, as are certain areas in technology, emerging energy companies, telecoms or media’ – Seth Frank, vice president of IR

Pentair

US rank: =172

Awards

Most progress in investor relations

What the investment community says: ‘The management at Pentair is good at IR but has other roles to play. The addition of Jim Lucas as head of IR has greatly improved responsiveness’ – sell side

What the company says: ‘I’m very lucky, working with a CEO and CFO who understand the importance of spending time with investors, and getting that access is obviously something shareholders want, so it’s something we try to provide as much as we can, whether that means getting out on roadshows or conferences, or having people come to visit us. It’s a luxury I know not all companies have’ – Jim Lucas, vice president of IR

Gigamon

US rank: unranked

Awards

Best investor relations for an IPO

What the investment community says: ‘Recently the best IPO in my space is Gigamon. It held a great roadshow, impressively fielding questions and keeping tight afterwards: good job’ – sell side

NXP Semiconductors

US rank: N/A

Awards

Best investor relations by a European company in the US market

What the company says: ‘Key to our approach is direct and honest bidirectional dialogue and information sharing with our investors. We focus on metrics that are measurable, transparent and consistent over time’ – Jeff Palmer, head of IR

MercadoLibre

US rank: N/A

Awards

Best investor relations by a Latin American company in the US market

What the company says: ‘When we talk about our company’s performance, investors require an understanding of the region as a whole, of what’s going on and which benchmarks help them understand how we’re performing’ – Diego Escobar, IR manager

Tencent Holdings

US rank: N/A

Awards

Best investor relations by an Asia-Pacific company in the US market

What the company says: ‘We believe in transparency and building trust with investors and analysts through sharing achievements, risks and solutions in our reporting’ – Catherine Chan, head of IR

Lifetime achievement in IR: Barbara Gasper, MasterCard

Barbara Gasper is a bulletproof vest for senior management, says Bob Selander, MasterCard’s chief executive at the time of the company’s IPO in 2006. He laughingly recalls how Gasper saved him from nearly attacking a banker on the IPO roadshow after said banker pulled out a competitor’s credit card to pay for dinner.

Chris McWilton, who was chief financial officer for MasterCard’s IPO, also recalls how Gasper helped propel the company through its difficult transition from a not-for-profit association to a much-admired public company. She’s a tough cookie, according to MasterCard’s current CFO, Martina Hund-Mejean, and ‘a consummate professional, an invaluable partner’, in the words of her chief executive, Ajay Banga.

JPMorgan analyst Tien-tsin Huang says Gasper is the best investor relations executive he’s ever worked with: ‘Highly ethical, fair, responsive and knowledgeable.’

Gasper, executive vice president of IR at MasterCard, started her career at Lukens then went on to handle IR for Raytheon, Lucent Technologies, PwC and Ford, where she was the first female investor relations officer. She has also served on NIRI’s national board and is a member of NIRI’s senior roundtable.